In the dynamic business landscape today, having efficient financial management is essential for success. If you are running a small business, accounting software can transform your working life. Accounting software is the easiest way to monitor money flowing in and out of your business and efficiently process your finances at the end of the year.

Two of the most popular accounting tools to help small businesses and freelancers today are QuickBooks and FreshBooks. Both of them are very powerful but have different use cases and are suitable for different businesses. In this article, we will compare these two tools and find out which is best for your business.

QuickBooks Overview

QuickBooks is a stalwart in the accounting software realm, and it caters to users from small businesses to large enterprises. The company was developed by Intuit and was launched in 1992. The cloud-based version- QuickBooks Online, which came out in 2001.

The tool has some versatile features, which range from expense tracking to payroll, tax preparation, and inventory tracking. It excels in automation and enables automated bank reconciliations, financial report generation, and invoice scheduling.

Click Here To Get 30% OFF QuickBooks

QuickBooks shines through its excellent customization features, which allow you to create tailored invoices, reports, and charts to efficiently align with your unique needs. QuickBooks Online offers great automation and customization, which make it a formidable contender as a comprehensive business financial management tool.

QuickBooks has been the leader for small and large business accounting for over the past two decades. The tool has over 80 percent market share in the United States, and it is used by several accountants and bookkeepers around the globe.

- Extensive features for businesses of all sizes

- Great inventory management capabilities

- Unlimited invoices, clients, and bills on all its plans

- Allows automatic sales tax calculation right in the tool

- Payroll add-on is available for all 50 states

- Highly scalable

- Excellent reporting features

- Has a vast network of independent QuickBooks ProAdvisors for support

- Project and inventory accounting are only available on the higher plans

- Lacks direct phone support

FreshBooks Overview

FreshBooks is a great accounting and business management software that was designed primarily for small businesses, freelancers, and self-employed professionals. It has a user-friendly interface with invoice management and expense tracking to efficiently streamline your financial tasks.

FreshBooks was launched in 2003, and it champions automation by automating your recurring invoices, expense categorization, and payment reminders. Its prowess in customization allows you to tailor reports, invoices, and dashboards to fit your brand identity.

The tool bridges customization and automation to offer a customization solution for businesses that want seamless management of their financial operations.

FreshBooks caters primarily to small businesses and independent contractors. It offers traditional double-entry accounting and reporting but excels at generating invoices. The unique ability lets you convert estimates and billing hours into invoices, which is great for service-based businesses that require you to pay on the go.

- Easy to use

- Good time tracking functionality

- Easy invoicing and estimation creation tool

- Offers professional-looking invoices

- Affordable pricing plans

- Good customer support

- Inventory management is limited

- Lacks features for larger businesses

- Access to fewer third-party integrations

QuickBooks vs FreshBooks

1. Ease of Use

The ease of using any software is the epitome for any user with different expertise and use cases. QuickBooks and FreshBooks are easy to use if users have some accounting experience. They also have shortcut buttons that allow you to navigate through different programs easily.

QuickBooks is an advanced platform having over 20 menu items and several widgets alongside charts and graphs. This allows you to efficiently summarize your business metrics and has an overall professional business interface. Despite its advanced features, the tool is user-friendly. On most pages, you have an option to take a tour through its interface and other options. Apart from this, some pages also have a walkthrough video explaining how to use its features. Overall, the platform can be easily used by any office manager without much hassle.

FreshBooks has a very simple interface that is easy to use for beginners who are new in the space. To start off, it requires minimal information to set up your company. The interface has bright colors with a clear breakdown of tools and few navigational options.

When it comes to ease of use, FreshBooks is the clear winner. However, as your business starts to scale up, FreshBooks exhausts its features, and there is no better option than QuickBooks.

2. Accounting

Accounting is the core feature of a financial management software. It helps you record, maintain, and report the financial affairs of your business and helps tell the financial position of your business. Both tools let you manage the finances and investments of different individuals, organizations, and other entities.

QuickBooks is geared to help small and especially big businesses handle their accounting, offering bank reconciliation across all its plans. The user-friendly software allows you to efficiently track your business income and expenses while organizing the financial information for you, which eliminates manual data entry. This helps make tax preparation easier.

The tool gives you multi-device access, and you can be assured that your data is secure using industry-recognized security standards to safeguard all your financial data. On top of it, the tool has accounting-specific integrations like budgeting, forecasting, inventory management, vendor billing, purchase orders, etc. Overall, the accounting software helps improve the overall accuracy of your offering.

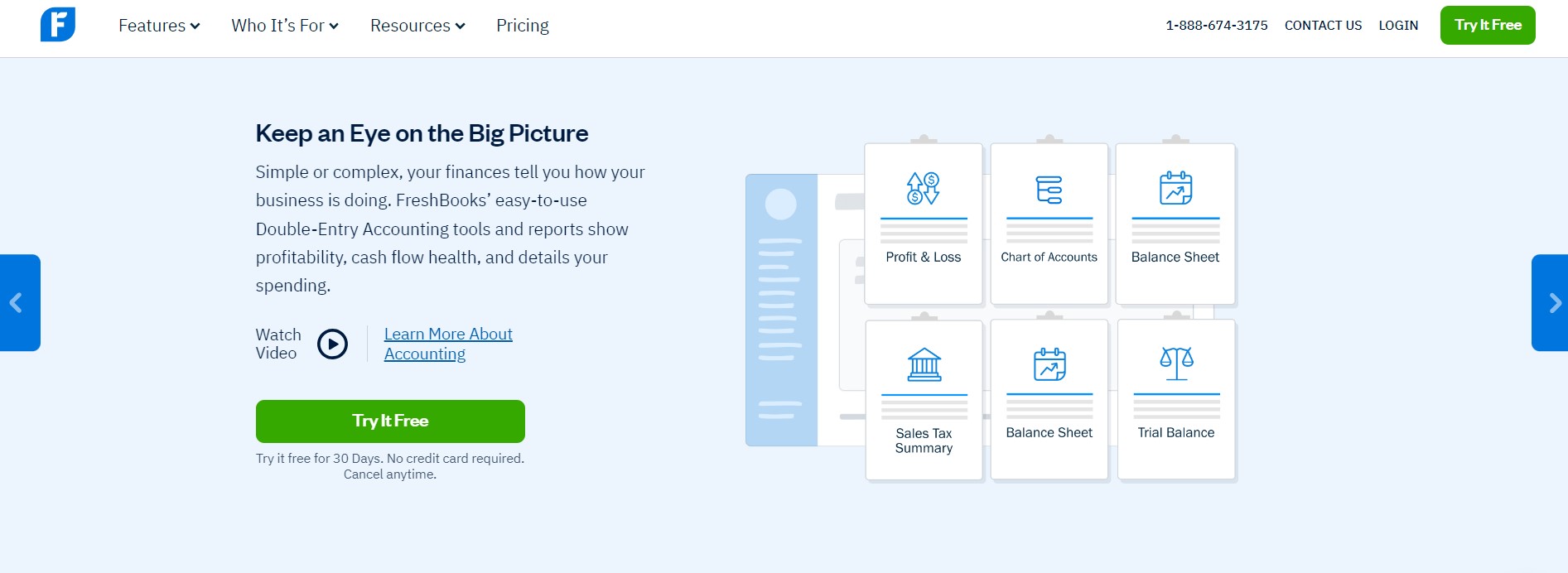

FreshBooks has easy accounting features and lets you know about your finances to see how your business is doing. It is primarily focused on client billing, and it offers double-entry accounting tools that will tell your precise profit and loss report, some of which are

- Balance sheet

- Accounts payable

- General ledger

- Trial balance

- Accountant access

- Journal entries

- Costs of goods sold

- Charts of accounts

FreshBooks accounting features are a bit limiting, and you are required to upgrade to its Plus plan to get access to its bank reconciliation features.

Keeping all this in mind, QuickBooks is a clear winner when you compare it with the accounting features offered by FreshBooks.

3. Invoicing

If your business is providing services, then there is a good chance to regularly invoice your clients. QuickBooks and FreshBooks help you create and send unlimited invoices for your business.

QuickBooks allows you to create invoices by taking the manual labor out of it. You can create custom professional invoices and turn estimates into invoices in a few clicks. The invoices can be designed with different templates, and they can be personalized as per your company’s logo and colors.

The tool allows you to efficiently track your invoice payment in real-time. It lets you automatically add time tracking data, which is available on its higher-end plans. The tool lets you enjoy fast payment matching and track whether an invoice is viewed or paid directly from your computer or cellular devices.

Further, it helps you automatically calculate your VAT, discounts, or shipping of your items. You can get time on your side using its automated invoicing features, which will help you with time as well as accuracy. Here, you can set up recurring invoices while also helping you get a clear picture of your due or overdue invoices. In case of failure to pay, you can send automatic reminder emails to your late-paying customer without lifting a finger.

FreshBooks invoice functionality has an invoicing panel having two tabs from me or to me. This helps you to easily accept or make payments to different sections of your business. The first will show you how you can easily create custom invoices, send payment reminders, or accept credit card payments. The second tab has a bunch of flashcards underneath its overdue accounts, so you can take a look at payments that have been cleared.

When you look at the invoice structure, it is simply bare bones in terms of design in the trial mode. It has an invoice generated where you can create and customize your invoice. However, you only have the option to customize its font, color, or set logos. If you want additional features, you will be required to be on its premium plans. It will take data from timekeeping directly to create invoices for hours that you had marked as billable. Further, you can also automate your invoices for better efficiency.

QuickBooks is the winner in this segment due to its excellent customization and automation features. However, it is important to note that QuickBooks relies on third-party tracking apps for recording billable hours, and this is not the case with FreshBooks.

4. Expense Tracking

Expense tracking is an important feature that allows you to create a budget for your business. If you are able to daily record your expenses by tracking receipts, invoices, and other outgoing expenses, then it will help improve the financial health of your budget. If you are able to track your expenses, then you can be on top of your cash flow and be prepared for the tax season. QuickBooks and FreshBooks have useful features when it comes to expense tracking.

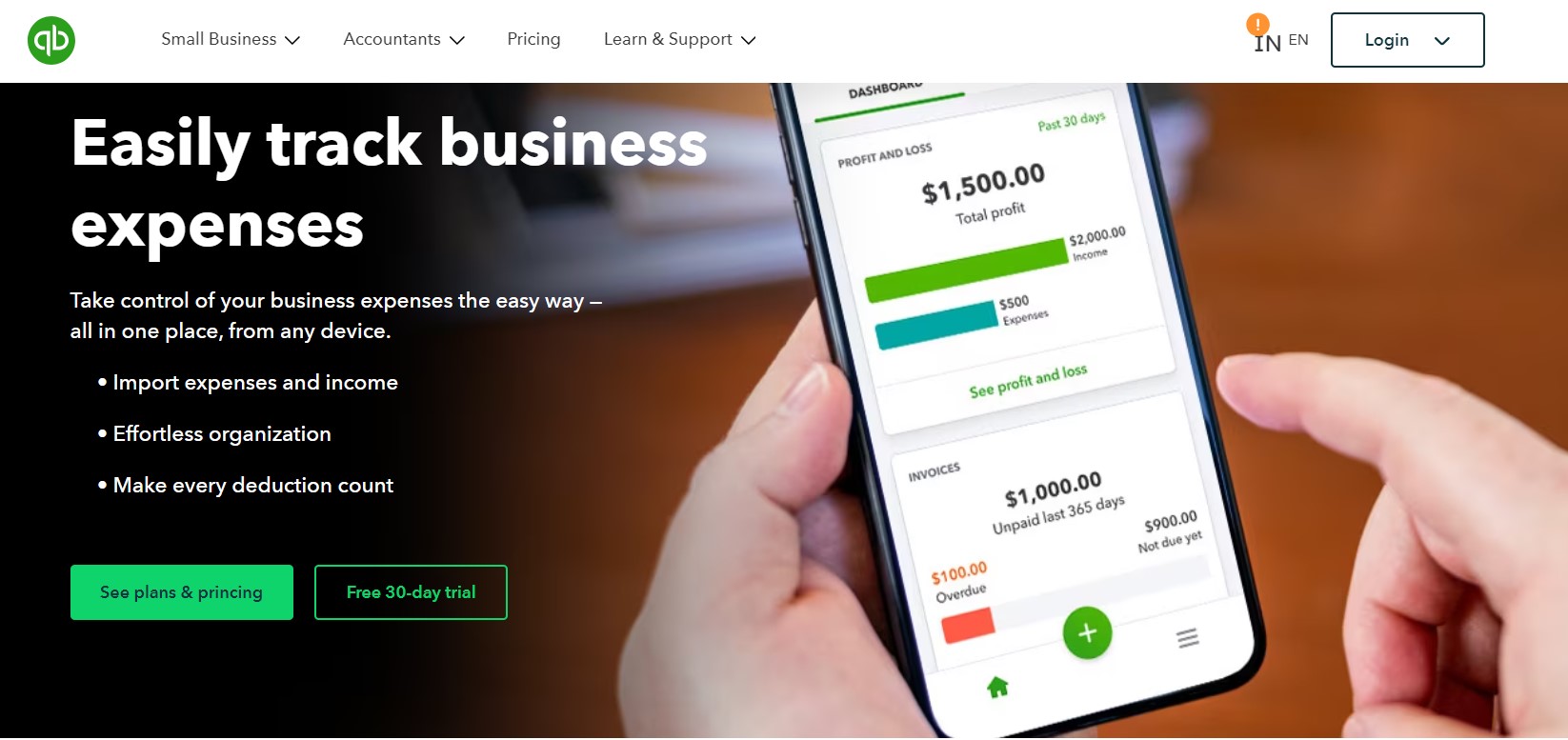

QuickBooks lets you take complete control of your business expenses in a simple way from any device. The tool lets you connect directly with your bank accounts, credit cards, PayPal, Square, and other platforms. You can easily import data across various accounts and easily categorize your expenses automatically. The tool lets you set custom rules for better expense categorization. You can easily snap and save a photo using its mobile app and run your reports to see how you are spending your cash.

The platform allows you to manage your cash flow throughout the year to provide the data you need to better predict and manage your flow of cash. You can view your cash flow statements, so you will be able to manage when you can spend, borrow, or transfer money. You can easily access and share expense reports.

Here, you can keep tabs on your business income alongside its expenses and outstanding invoices with its built-in reports. Further, you can gain insights at a glance using its profit and loss reports. Easily share your reports with your accountants to gain a greater perspective of your business.

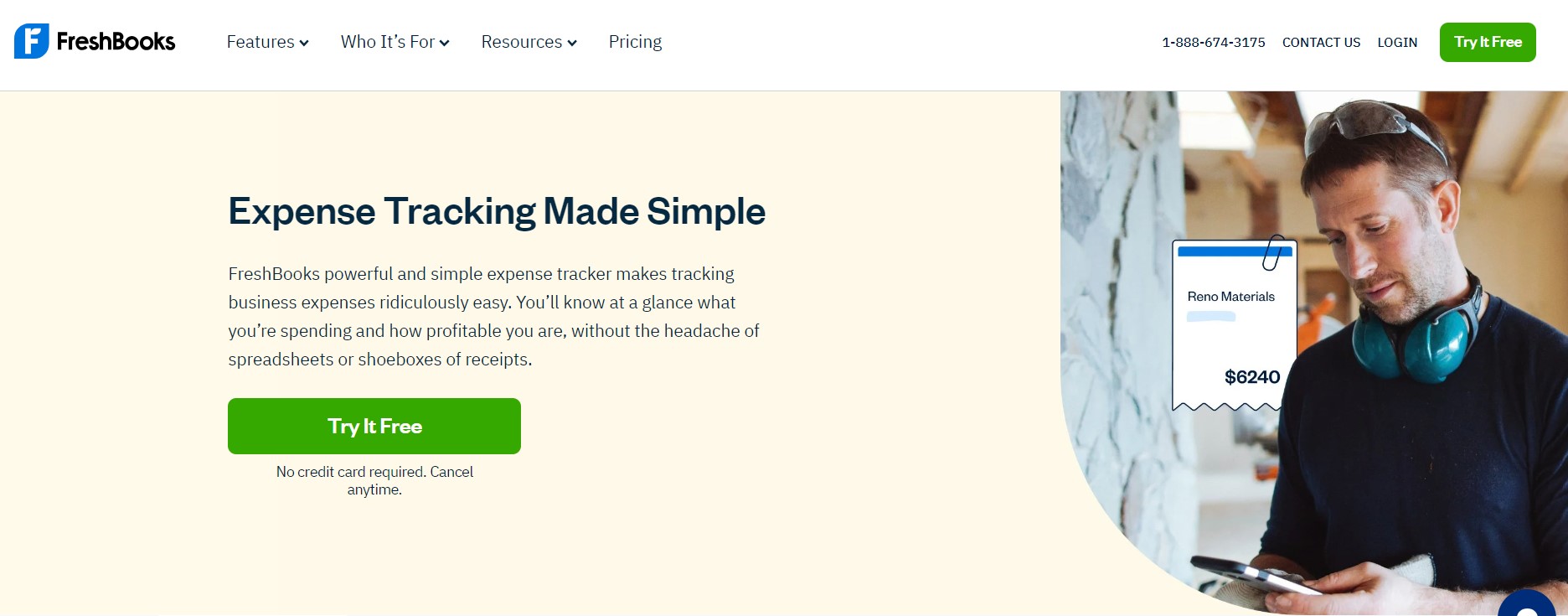

FreshBook has simple expense tracking, which makes tracking your business easy. It allows you to connect to your bank accounts and always stay updated with your records. You can categorize your expenses similar to QuickBooks to be tax prepared. The tool lets you easily bill your clients for additional expenses by adding your markups for billable expenses.

The platform offers real-time expense tracking data and uses multi-currency for better calculation. You can assign recurring expenses to be organized for tracking. The automatic mobile receipt scanner lets you scan and save paper and digital receipts. Here, you can auto-capture the merchant, totals, and taxes.

Apart from this, you use email receipts directly from your account to capture transactions. Finally, you can securely store your receipts in the cloud, and you can access them through mobile and desktop devices.

FreshBooks’ expense tracking feature is precise for client billing, while QuickBooks has additional supplier and contractor tabs that help keep your expenses organized. This gives QuickBooks a slight edge over FreshBooks.

5. Time Tracking

Time tracking allows you to keep track of the time that you have spent on various projects, tasks, and other business deliverables. It allows you to stay organized and helps easily pinpoint distractions to make smart business decisions to allow you to become more productive and profitable.

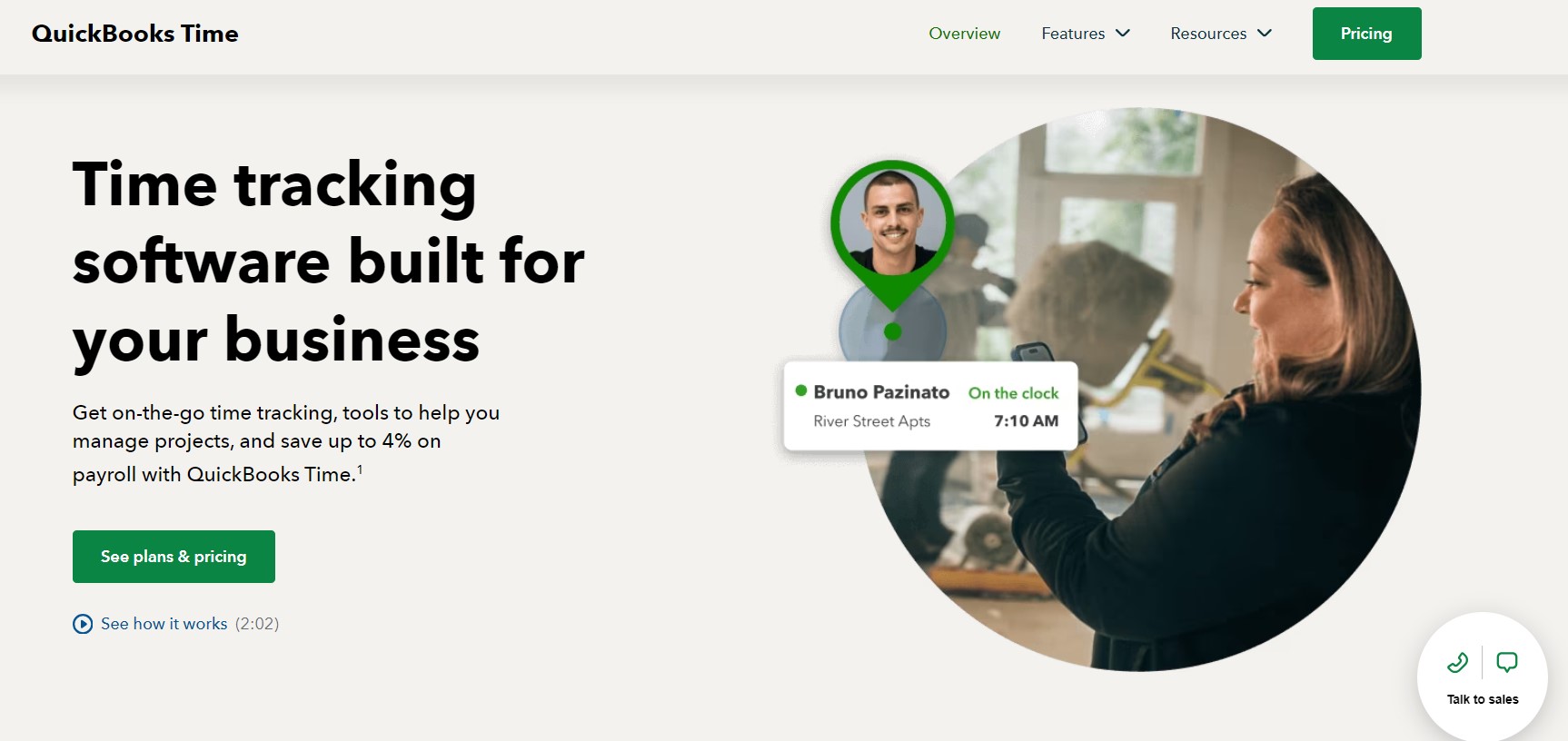

QuickBooks has a versatile time-tracking feature to help you efficiently manage your projects. The feature is available on its higher-tier plans and is a better choice for larger sales teams. Using it, you can manage multiple timesheets, customizable reports, seamless integrations, and great team management features.

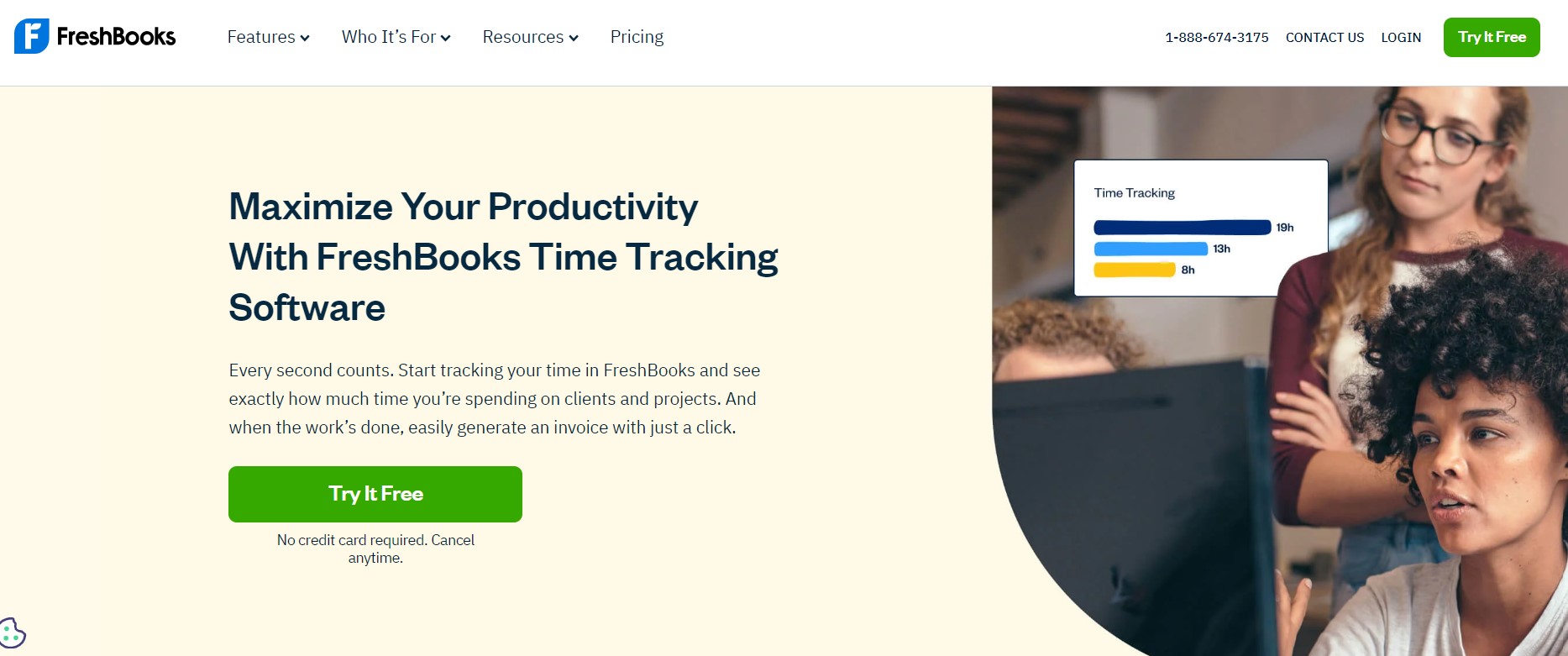

FreshBooks has built-in time-tracking features that are great for beginners. You can select it, hit the start timer button, and FreshBooks will start recording it. After you have done this, you can utilize the generate invoice button, and it automatically adds hourly data to your invoices. Using the feature, you can track time from wherever you are, easily keep track of your team, record time against a specific client, and more. To top it all, the time-tracking feature is available on its plans.

When it comes to time tracking, FreshBooks is a clear winner as it is available on all its plans and also has better overall features in this aspect.

6. Inventory Management

Inventory management is essential to stay updated with your stock. In the past, businesses would use pen and paper to count and write the content, but today, with advanced software, things have become simple and easy.

QuickBooks inventory management is very impressive. It goes beyond tracking with excellent reporting and analytics features. Its Plus and Inventory plans allow you to manage your vendors and inventory and create purchase orders. You can easily add images of inventory items, bundle products, or services that are sold together, which will save you from having to enter them into an invoice separately. There is also an option to track inventory and show the quantity of stock. This is a great feature for businesses to maintain extensive inventories.

FreshBooks has simple inventory management features. It will keep you updated with your list of inventories, when an item is invoiced, low stock amounts, etc. This feature has been added lately to the platform, so it is in its infancy stage.

QuickBooks is a clear winner as it has excellent features in this aspect. The inventory management features of FreshBooks are recent, and a lot of work has to be done to get into talking terms of what QuickBooks has to offer.

7. Automation

Automation has become a cornerstone for running modern business operations to significantly enhance your efficiency and accuracy. QuickBooks and FreshBooks have a range of automation features to streamline your financial processes, save you valuable time, and minimize errors.

QuickBooks is renowned for its comprehensive automation alongside its financial management capabilities. The tool automates expense recording and categorization, which allows you to capture important data to minimize errors and accelerate your work. This lets you maintain a clear overview of your financial outflows. The automation capability lets you simplify crucial tasks of bank reconciliation. Using its automated bank feeds and transaction matching algorithms, it will automatically reconcile bank statements using its recorded transactions.

FreshBooks has a suite of automation tools to efficiently track your expenses and categorize different parts of your financial system. You can easily synchronize automatic bank feeds by directly connecting to your bank account.

QuickBooks and FreshBooks allow you to harness their automation to completely help businesses eradicate manual tasks. However, QuickBooks has a slight edge, making it a better choice in terms of automation over FreshBooks.

8. Customization

Customization helps businesses tailor their financial management process to align with their requirements and tailor it to their brand needs. You get an array of customization options with both tools.

QuickBooks is known for its customization and adaptability and has an array of customization features. It has a user-friendly interface that allows you to efficiently customize your invoice templates to add your own elegance. QuickBooks allows you to create your own unique financial structure. You have the option to modify their account charts and classify them into different categories and classifications. Finally, the tool gives you the ability to offer custom user permissions for your users, giving you complete control of your security.

FreshBooks gives a personalized touch to your financial interactions with its customization features. It facilitates invoice customization and expense category customization, to name a few. Apart from this, it lets you customize your client communication by customizing email templates and messages as per your requirements.

When it comes to QuickBooks and FreshBooks they allow businesses to customize their financial management to suit distinct requirements. And both of them are equal in this aspect.

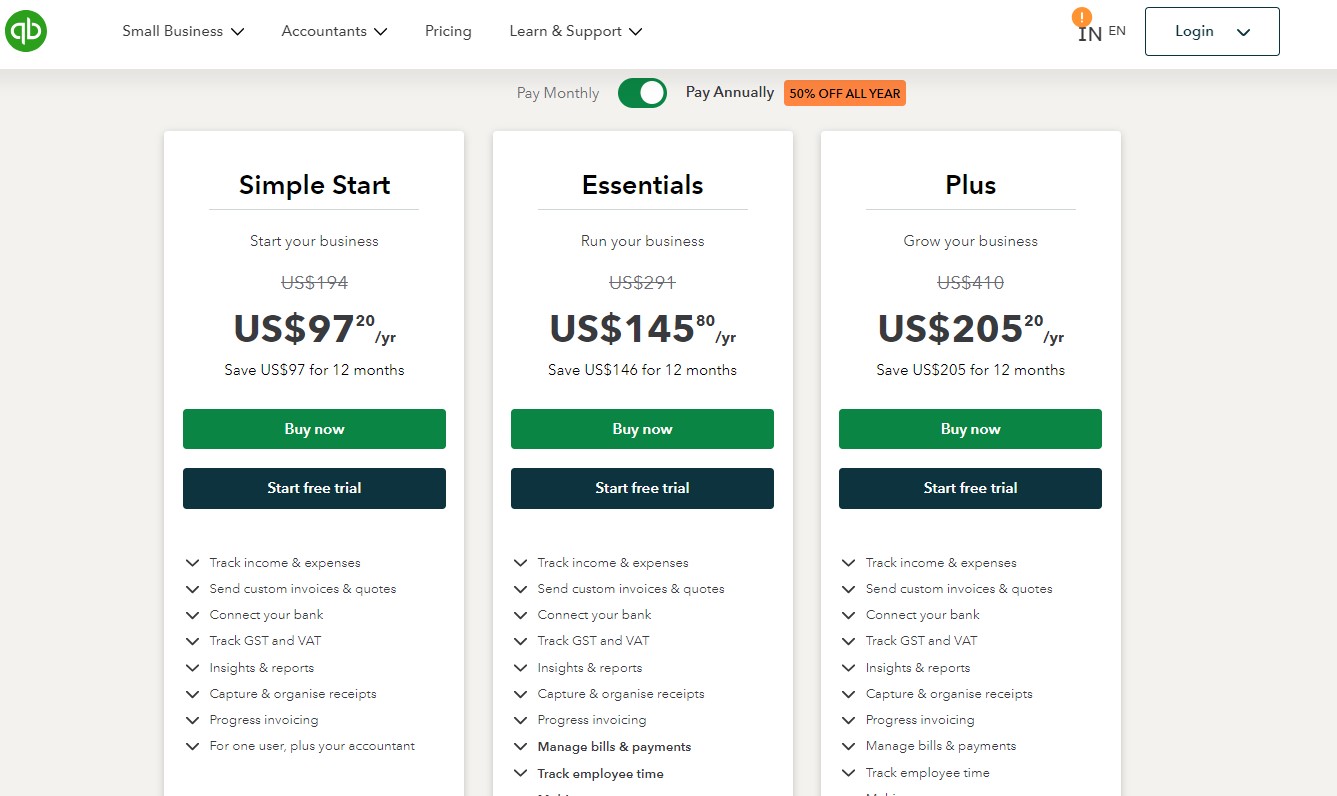

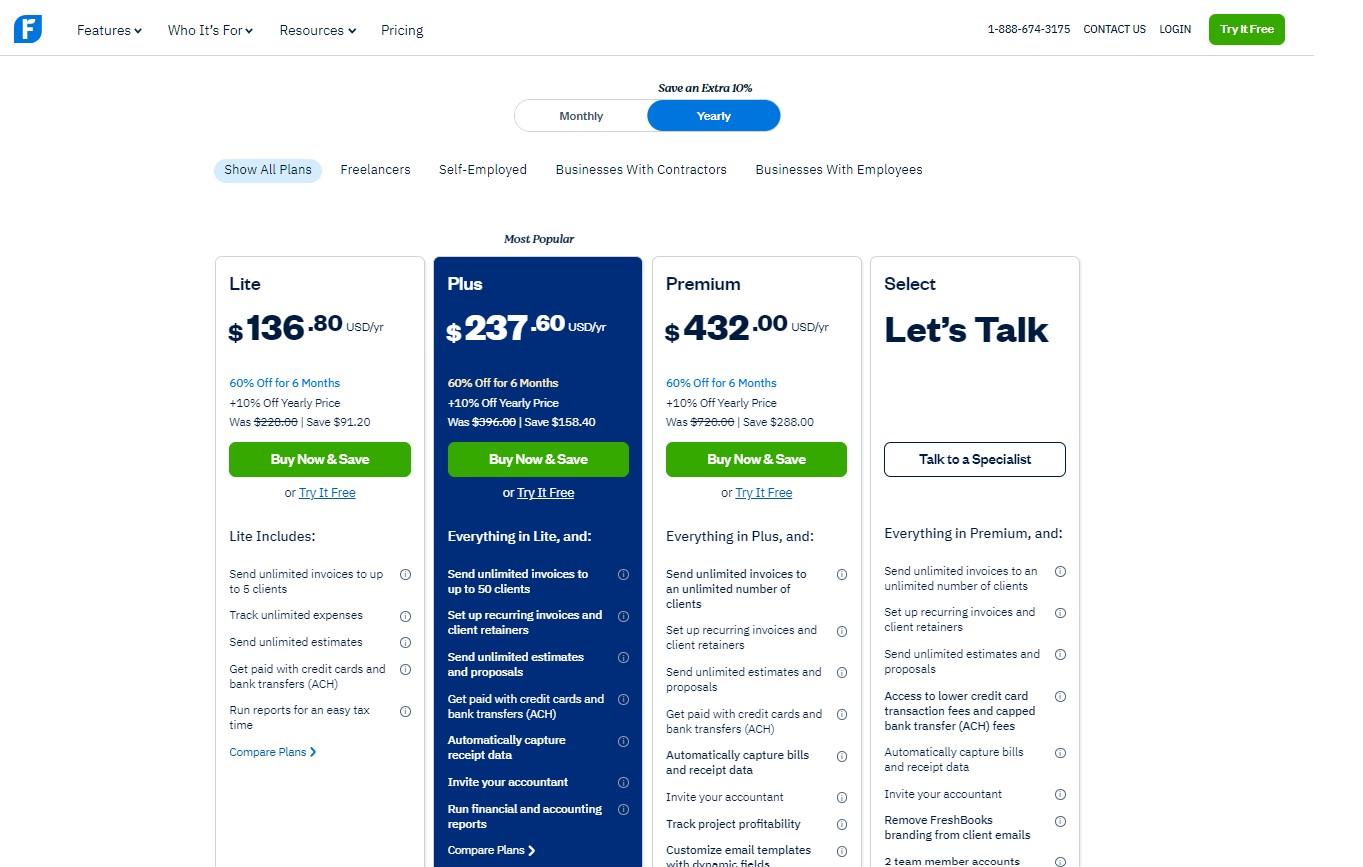

9. Pricing

You might want the best accounting software for your business, but as a small business owner or freelancer, you have to be price-conscious to get the best results. Both QuickBooks and FreshBooks are affordable, and their plans come with different perks and features that help differentiate them effectively.

QuickBooks has 3 plans, and they have a 30-day trial period to check its offerings. If you decide to forgo the trial period, then you will get 50% off for three months. Its plans can be purchased on a monthly or yearly subscription basis. The tool doesn’t limit the number of clients, as in the case of FreshBooks. However, it has a limit on the users you can have on your account. Its three plans at the time of writing are the Simple Start plan ($97.20 per year), the Essentials plan ($145.80 per year), and the Plus plan ($205.20 per year).

Click Here To Get 30% OFF QuickBooks

FreshBooks has 4 standard plans with a 30-day free trial to check its features. Its plans can be purchased on the annual or monthly plans while you save 10% on its annual plans, which is cheaper in comparison to that offered by QuickBooks. Its biggest disadvantage is that it has limitations on the maximum number of billable clients on each plan. Its plans at the time of writing are the Lite plan ($136.80 per year), the Plus plan ($237.60 per year), the Premium plan ($432 per year), and the Select plan (Custom pricing and features).

If you are managing and invoicing several clients, then QuickBooks is the best choice at the price point it offers. However, if you are looking to only track time, then FreshBooks is a good choice at a lower price point. Overall, QuickBooks is an excellent choice in terms of pricing compared to FreshBooks.

10. Reporting

Reports let you efficiently dig through the details of your transactions and get a bigger picture of the finances of your company.

QuickBooks reports allow you to get deeper insights into your business. The tool has 200+ built-in templates of different genres. You can get access to the desired reports by applying certain filters, adding or removing data points, and adding custom fields on a few metrics of your business. You also have the option to build fully customizable reports from any data set.

The reports of QuickBooks include

- Balance sheet

- Profit and loss by customer

- Statement of cash flows

- Profit and loss by a certain % of total income

- Sales by customer summary

- Transaction list by vendor

- And more

The tool has multi-company reporting features that allow you to combine reports across multiple businesses. You can also create intercompany transaction reports, which allow you to filter them by date and range for better insights into your historical transactions.

They have budgeting and forecasting tools that help you create, revise your budget, plan, and forecast your scenarios. Now, you can create next year’s budget or check the profit from the past year. This helps predict your future revenue and your cash flow.

FreshBooks makes it easy to check how your business is exactly performing. It has a simple dashboard, and the reports help evaluate what your business is doing. You get access to 7 ready-made reports whenever you need them, which include

- Invoice details

- Expense details

- Profit and loss

- Aging accounts

- Tax summary

- Payments collected

FreshBooks keeps all your numbers in a single place, from the money you have collected to the taxes you have to pay or paid and everything in between.

QuickBooks wins it when it comes to reporting due to its customizable templates and advanced reporting functionality that gives it an edge over FreshBooks.

11. Mobile Apps

The mobile apps of QuickBooks and FreshBooks are actually very good. Having your accounts on the big screen is preferable; however, data on your mobile devices can help you when you are on the move.

QuickBooks mobile app is intuitive and its dashboard has a summary of current financials of whatever time period I choose. You can easily look at where money is flowing in and out of your business. It offers more than that and you get access to all the features that you get on your desktop version. Here, you can create or send invoices, track mileage, as well organize your income and expenses on the go.

FreshBooks mobile app’s first page is similar to QuickBooks. You get access to the summary of your income and expenses for a selected period. Here, you get useful charts and graphs showing all the stuff you will want to see.

Both tools have identical offerings when it comes to their mobile apps, so selecting a winner amongst them is not possible.

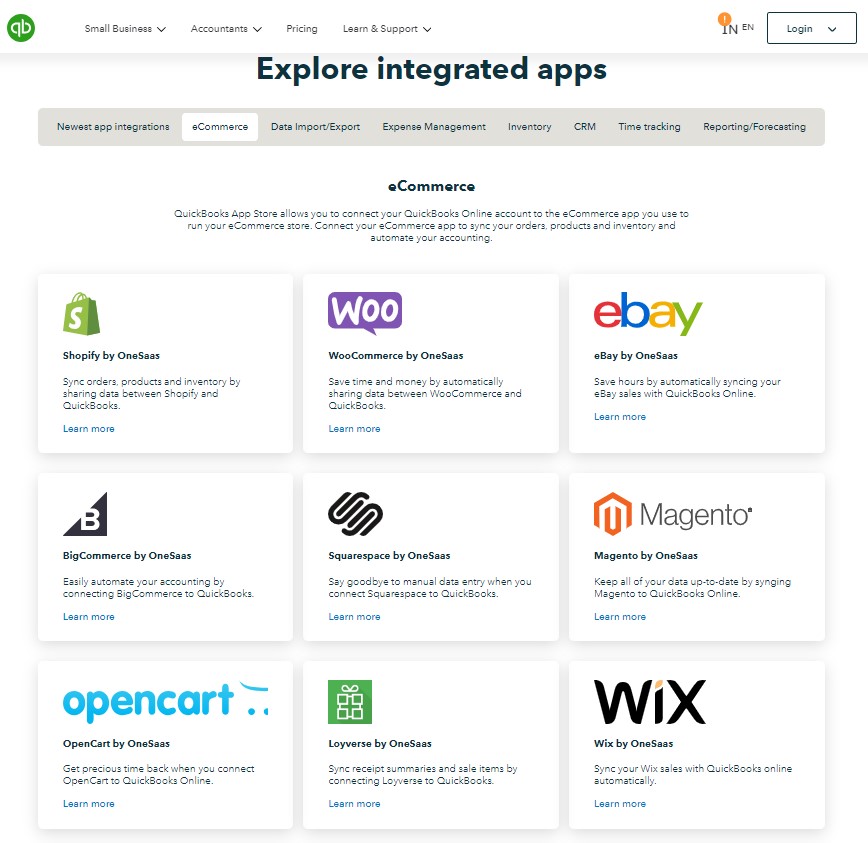

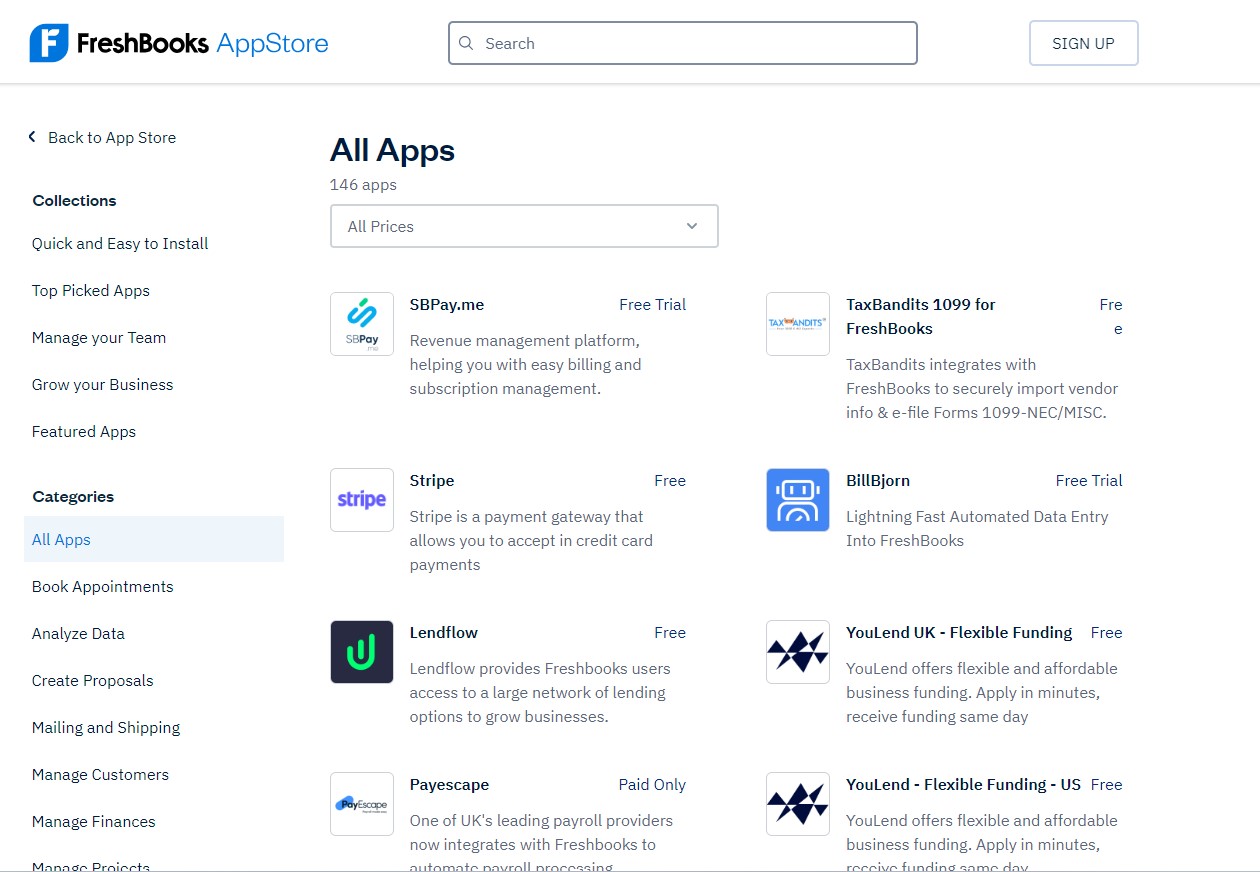

12. Integrations

Integrations play a pivotal to enhance your offerings by connecting directly to apps without having to switch over multiple tabs. QuickBooks and FreshBooks have an extensive library of third-party applications.

QuickBooks comes with over 650 amazing apps that will swiftly integrate with it. A few popular apps that it has are Shopify, Amazon Business, Fathom, Wix, LivePlan, etc.

FreshBooks has 70 unique integrations to manage your platform. Some of the platforms it integrates with include Shopify, WooCommerce, Stripe, Payescape, etc.

The platforms are reasonably matched, but QuickBooks is a clear winner due to the sheer number of integrations available with the tool.

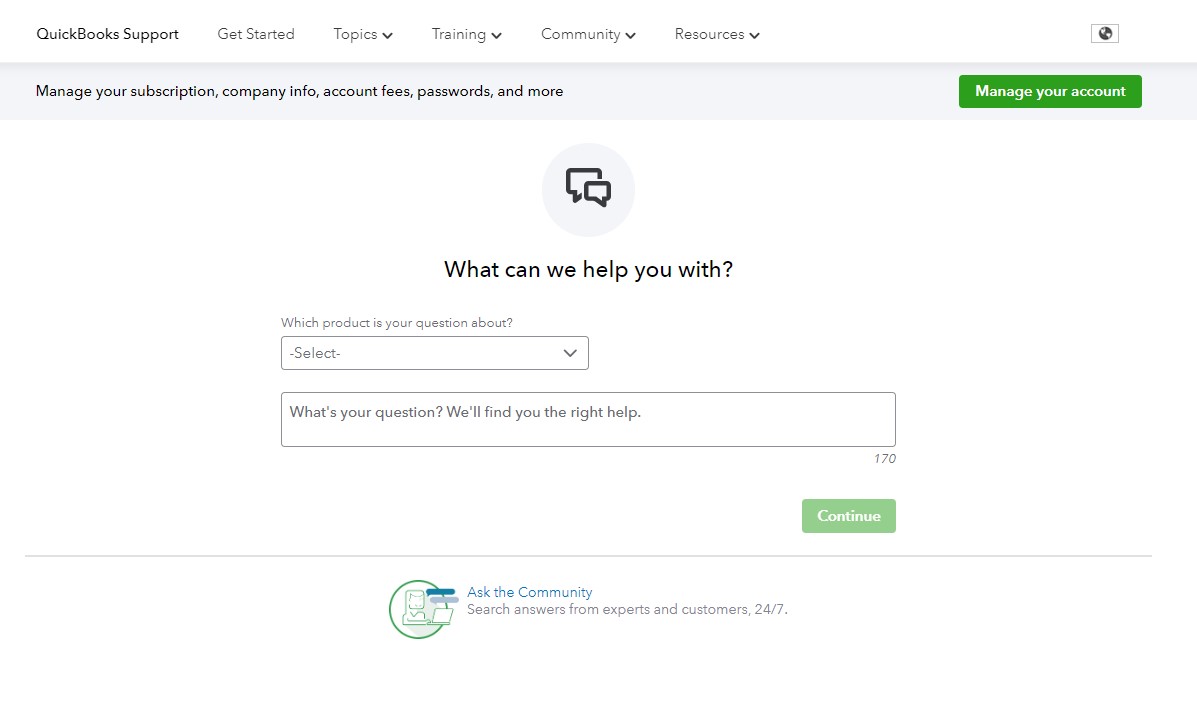

13. Customer Support

If you run into any issues, you will require good customer support to resolve any issues you might be having. Both tools offer great customer support offerings and can resolve all your queries in a short time.

QuickBooks has excellent support, and you can contact them via phone or live chat, which you can access from the website. You can also access its knowledge base or ask any question you may have in its community forum. There are also tutorial videos or webinars you can use to find answers as well as enroll in training classes. Any new posts or features are posted on the blog of the tool every month. Alongside this, it has articles that may interest small business owners. If you want in-person assistance, then you get local certified QuickBooks ProAdvisors who offer one-on-one help using the software for your business.

FreshBooks offers support via multiple support resources like phone, email, live chat, or its online knowledge base. It has access to webinars, blog posts, or free eBooks that have in-depth information about using the software. The tool has an automated chatbot that can assist with basic questions. If you have more questions, you can contact the sales representative through email or phone.

QuickBooks and FreshBooks offer great customer service offerings, but there is no clear winner amongst them in this aspect. However, compared to other tools in this segment, QuickBooks is money’s worth when it comes to its customer support due to the enormous customers it has.

QuickBooks vs FreshBooks: Which is Better?

In the modern financial management ecosystem, QuickBooks and FreshBooks offer a robust solution. Both are good in their own rights, but FreshBooks is ideal if you are starting out in the market. However, QuickBooks offers a complete solution for your business, may it be in terms of accounting, invoicing, automation, and the other parameters we have discussed in this article. So, as per me, QuickBooks is a clear winner when you compare it with FreshBooks.

QuickBooks vs FreshBooks FAQs

1. Does QuickBooks and FreshBooks have a mobile app?

Yes, both accounting platforms have an online app for both iOS and Android users.

2. Does QuickBooks support multicurrency invoicing?

QuickBooks offers good multicurrency invoicing, which allows you to efficiently invoice customers based on their local currency and manage your foreign exchange rates easily.

3. Can you use FreshBooks to track your inventory?

FreshBooks doesn’t allow you to create inventory items and track total units or costs. You have the option to add inventory to an invoice; however, FreshBooks doesn’t utilize that information to track your inventory.

4. Are QuickBooks and FreshBooks the same?

No, but both are competing accounting software. FreshBooks is owned by an independent company, while QuickBooks is owned by Intuit, which has software like TurboTax and Mailchimp, giving it a better outreach in the market.

Leave a Reply