QuickBooks Online is a cloud-based accounting software that’s specifically targeted towards helping small businesses manage all their transaction records, expenses, invoices, etc, and to help them centralise all their businesses financial activities to make it easier for them to manage.

Established in 1983, Intuit originally launched their first software called Quicken that became popular as an MS-DOS and Apple-II based software for individual financial management. As Quicken didn’t function as a ‘double-entry’ accounting software, Intuit launched QuickBooks based on the Quicken codebase to help fill the gap left by Quicken for accounting professionals and businesses.

By 2000, Intuit developed and launched QuickBooks in the form that we know it today in Basic and Pro packages which were further categorised into industry specific versions over the years. Today, QuickBooks is available in 3 main forms – QuickBooks Online, QuickBooks Desktop, and QuickBooks Enterprise.

Click Here To Get 30% OFF QuickBooks

Quickbooks Discount Code: Auto Applied

QuickBooks Online Review

If you search for ‘The Best Accounting Software’, you’re sure to find QuickBooks by Intuit to consistently show up as one of the top results, and rightly so.

QuickBooks is extremely feature rich, and I don’t say this lightly. As we start going over each of its features, you’ll realise that its list of functionalities is extensive, to say the least, and addresses almost every key requirement of a good accounting software.

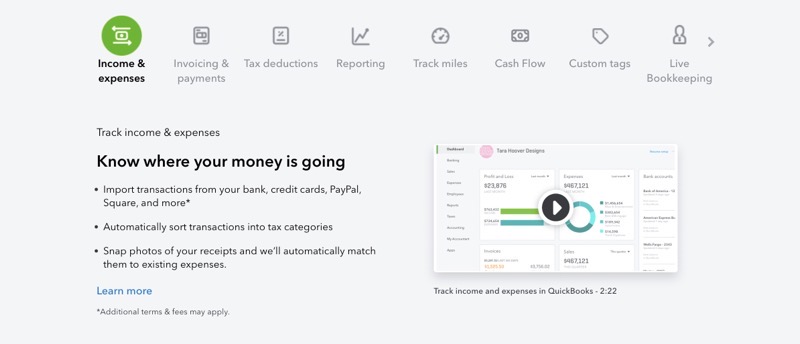

1. Tracking Income & Expenses

With QuickBooks, you can connect everything from your Bank Accounts, Credit Cards, Payment Processors, and more and it’ll import all your transactions and even categorise everything for you. You can set custom rules to automatically categorise recurring expenses and get a clear insight into your spending habits.

You can take photos of receipts on the go with their user-friendly mobile app and QuickBooks will automatically match receipt information to an existing transaction so you don’t have to worry about remembering to input every expense when you’re on the move taking care of business.

Fulfilling tax obligations is mandatory and every business owner and their accountant knows how stressful tax time can be. But with QuickBooks, you’re able to easily track all business expenses, sort them into categories, and stay fully organised all year round.

By consistently analysing expenses, QuickBooks makes it easy to manage cash-flow. With an in-built cash-flow statement, you can log in any time and quickly see how much money you have left over to cover bills.

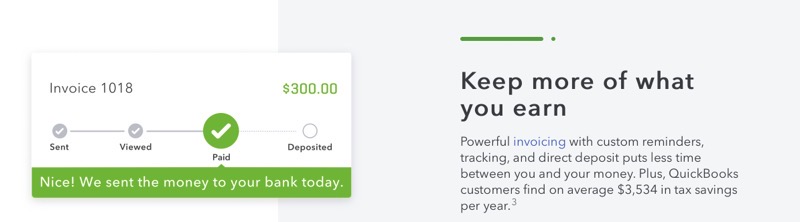

2. Smart Invoicing

When a job is done and it’s time to get paid, QuickBooks takes care of invoicing and makes it easy for you to get paid fast with online invoicing. Your customers can choose to pay with their Debit or Credit Cards or Bank transfers straight to your bank account.

It lets you fully customise your invoice with your logo, business branding colours so you can send professional looking invoices in-line with your branding.

With accelerated invoicing, you no longer need to manually enter data into invoices. Quickly duplicate invoices, upload files, and get more time back into your daily life.

You can also add recurring payments for customers that subscribe to your services and even sync QuickBooks with TSheets, Google Calendar, or even QuickBooks Time Tracking to automatically add billable hours to invoices for your customers.

With advanced tracking features, you’ll know exactly when your customers view invoices and receive real-time alerts as soon as they make payments. The best part is, you can even set payment reminders so there’s no more late payments from your customers or unnecessary follow ups required on due invoices.

With its integrations with payment processors and your bank accounts, QuickBooks will instantly match payments with invoices regardless of whether your customer pays with their Card or an ACH Bank transfer, saving you time and squaring off your books in real-time.

3. Payments

With QuickBooks Payments, you can accept credit cards, debit cards, and even bank transfers into your bank account. Just send an invoice with a Pay Now button and instantly get paid for your services.

If your customers would like to pay with their card over the phone, you can even key in customer card numbers to accept payments on their behalf. With a Free mobile card reader, you can Swipe, Tap, or Dip your customers’ cards to accept payments in person on the go.

All sales are automatically recorded and updated into QuickBooks in real time and you can also set up recurring payments to charge your customers on a monthly schedule if you want.

QuickBooks Payments have no upfront costs or hidden fees. They charge you 1% on all Bank transfers up to a maximum of $10. For Card transactions, they charge a flat rate of $0.25 + 2.4% for Swiped, 2.9% for Invoiced, and 3.4% for Keyed in transactions.

You don’t have to wait for the money to come into your account for ages. They transfer all payments to your account the next business day and let you keep tabs on your bank balance, so you know when payments hit your account.

Click Here To Get 30% OFF QuickBooks

Quickbooks Discount Code: Auto Applied

4. Tax Deductions

If you dread tax season, you’re not alone. Almost every small business owner knows the feeling – you only want to pay the tax that you’re obligated to but also want to make sure you’re doing everything right to avoid getting audited.

Get organised with QuickBooks tax categories, or just set up your own categories to record and organise business transactions so you’re ready when it’s tax time and don’t have to rush at the last minute. You can also use their automatic quarterly tax calculator to figure out exactly how much money you need to keep aside for tax so there’s no more last-minute surprises.

With their on-demand Sales Tax Liability Report, you can view your sales tax information anytime and stay fully up to date on all your sales – taxable and non-taxable broken down by tax agency.

5. Mileage Tracker

Tracking mileage can lead to massive savings for your business. Whether you drive full-time, part-time, or even make the occasional delivery to a client, keeping track of your mileage can help you claim as much as a 58% deduction per business mile.

By letting QuickBooks access your GPS, you can drive around while it tracks the miles for you, or you can choose to enter miles manually as well. Obviously, not all trips involve business activities, so QuickBooks lets you easily categorise trips as business or personal to accurately keep track of miles and potential deductions.

You can see detailed mileage reports broken down by categories and deductions and even share them if you need to. Remember, the IRS needs you to keep track of your miles for up to 3 years, so if you don’t want to keep a paper and pen log, QuickBooks will keep a digital mileage log stored and accessible on your phone at all times.

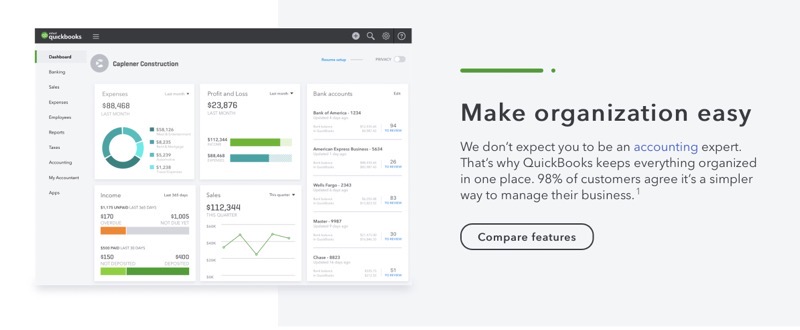

6. Business Reports

Monitoring cash flow and having a clear idea of where your business stands are essential to running a business and QuickBooks makes it easy for you to get a quick overview of your business at a glance.

With smart reporting that’s powered by Fathom, you can make smart and well-informed business decisions to keep your business growing and profitable. Whether it’s analysing profitability, cash flow, or any other KPI, QuickBooks gives you all the necessary tools and metrics in a single dashboard with monthly KPI tracking to gain insight into your business activities which will help you make informed decisions.

You can stay on top of your business with smart and customisable visual reporting that’s easy for you to understand and even easier for you to share with your investors and stakeholders. So you’re always ready to deliver clean and visual reports with advanced analytics and insights in a matter of minutes.

7. Estimates and Proposals

When you’re sending estimates and proposals to your clients, you’re giving them a glimpse into doing business with you. With QuickBooks Online, you can create professional estimates complete with product SKUs, payment terms, and any other information you need to include right on your mobile and email it directly to them or even let them accept and sign it on your mobile in person.

All templates are fully customisable to represent your business and brand effectively. Adjust layouts, add logos, include personal messages, and even add custom fields for tracking and reporting in a matter of minutes.

Once you’ve impressed your clients with your estimates, you can set when you want to convert the estimate to an invoice, and QuickBooks will automatically do it for you. You can also choose to include a Pay Now button in your invoices to get paid easily and instantly when your customers receive their invoice with QuickBooks’ flexible payment options.

Click Here To Get 30% OFF QuickBooks

Quickbooks Discount Code: Auto Applied

8. Sales Tax Calculation

Keeping track of ever-changing tax laws can be challenging. Fortunately, QuickBooks will do the hard work for you and keep track of all tax laws to make sure when you add sales tax to an invoice, it automatically calculates the sales tax rate based on the date, location, product or service being sold, and the customer who is availing said products or services.

Because tax rules and laws change from state to state, once you’ve categorised all your products, QuickBooks takes care of applying the correct tax rate on your transactions based on your selected product categories and locations of your sales.

At any given time, all you need to do is log into QuickBooks and look at your Sales Tax Liability Report to get an up to date report on all your taxable and non-taxable sales categorised based on the tax collecting agency.

9. Bill Management

Managing payments for vendors can be a task when you’re dealing with multiple vendors with a variety of payment terms. Being late with paying your bills can reflect poorly on your business as well.

QuickBooks makes sure you pay on time every single time by letting you easily track your bills and their due dates all in one place so you can say goodbye to late fees and penalties. No more missed payments or interest charges when you can set up recurring bills to be paid monthly automatically.

Once you’ve paid a bill, QuickBooks will automatically record your bill payment and will sync with your bank account and credit card to match payments with bills, so you don’t have to record each transaction manually.

You can set up online bill payments with apps like Bill.com, Entryless, Veem, and more, and use multiple payment methods like Credit cards, Cheques, and Online Banking to make your payments. To make batch payments just select multiple bills and set a date for when you’d like them to be paid and QuickBooks will automate the bill payment for you via electronic payment.

If you’re used to paying your suppliers with Purchase Orders, QuickBooks will record your purchase orders and turn them into bills once the order is complete, so you don’t have to do it manually.

10. Users and Access Levels

A smooth-running business is like a well-oiled machine with a lot of moving parts. QuickBooks understands that every organisation has multiple employees that may need access to the accounting system from time to time, whether it’s to create proposals, track miles, send invoices, or accept payments.

You can create and set user roles and permissions based on how much control you’d like to give each user and the level of access they may require. Whether its sales reps that need to create proposals, managers that need to manage payments, or partners who need to view detailed accounting and taxation reports.

Your employees can even use QuickBooks’ time tracking to track billable hours and make it easy for you to manage and pay them for their work.

If your accountant needs access, you don’t have to share your username and password, just create a separate login so they can access the software on their own without compromising your credentials.

11. Tsheets

Time is money, for both you and your customers – so make the best use of both and let QuickBooks manage time tracking for you. You can seamlessly sync employee times into QuickBooks Online and use Tsheets to have accurate time sheets making managing payroll easier and saving you time and money in the process.

Tsheets gives you accurate time tracking against jobs or specific customers on any device right up to the minute. As the time data syncs with QuickBooks Online, you can save as much as 5% on payroll costs by shaving off 3 hours spent on managing payroll on average.

If you’re worried about Tsheets draining your battery or consuming precious data, you don’t have to be, Tsheets uses no more data or battery than your average social media app while giving you real-time insights into your business and helping you manage your projects with clear and precise reports of employee hours.

12. Tracking Inventory

As tedious as it can be to track inventory, it’s an essential part of running a business. Automating inventory management with QuickBooks can save you a massive amount of administrative work and help you put an otherwise time intensive task on autopilot.

Whether you sell on Amazon, Etsy or Shopify, QuickBooks will sync with all three and help you keep track of your inventory in real time as you make sales. It automatically updates quantities as you work and will keep you on top of your stock management with a clear idea of what’s on hand to prevent stock shortages.

QuickBooks will also notify you when it’s time to reorder inventory so you can avoid backorders and once you’ve received new inventory, QuickBooks will convert any Purchase Orders for the inventory so you can be on top of your vendor payments as well.

Wondering what your best sellers are or how much your sales have been or even how much you owe on taxes? QuickBooks stays one step ahead with Inventory Summary reports helping you stay on top of your business at all times.

Click Here To Get 30% OFF QuickBooks

Quickbooks Discount Code: Auto Applied

13. Managing 1099 Contractors

As a business owner, it can get confusing keeping track of who’s a full-time employee and who’s an independent contractor. But for tax purposes, it’s important to know which employee belongs under which category to make sure you’re fulfilling your obligations and are compliant with IRS tax rules.

To stay compliant with tax rules, you need to track all payments made to contractors or labour on a 1099. With QuickBooks Online Plus and Advanced, you can automatically track payments made to contractors and also generate ready to send 1099 forms for when it’s tax time.

Differentiating between contractors and vendors for payments with rentals and supplies can further add to the complexity. But QuickBooks can track those as separate expenses. By keeping contractor payments and expenses separate, it’ll be easier for you to issue and file accurate 1099 forms each tax year.

The best part is, QuickBooks is an IRS approved e-file provider, so if you need them to file your 1099, they offer a one-click service starting at $14.99 for three forms that’ll be transmitted securely for you. If you’d like to print the forms yourself and submit them manually, remember, these forms are due to the IRS on the last day of February, so plan accordingly.

14. Payroll & HR

A major part of managing a business is taking care of the most essential part of your business – your employees. Keeping track of payments and managing payroll can be a major task depending on the size of your company and the number of employees you have.

QuickBooks is one of the top payroll providers and can help you manage your payroll, HR, and workers’ comp with ease. Simply run payroll automatically after you’ve completed your initial setup to get started. Auto Payroll will make it easy for you to stay in control with clear and timely alerts and notifications. QuickBooks can also file your federal and state payroll taxes if required, so you can delegate that task and save yourself precious time that can be dedicated to managing your business.

If you find yourself out of your element with managing payroll, QuickBooks has expert help available on hand to help you set up payroll or even completely manage it for you. They’ll help you resolve any errors you’ve made while filing payroll taxes and even reimburse any penalties or interest costs with tax penalty protection that’s included with QuickBooks Online Payroll Elite.

You can also get access to expert HR guidance from QuickBooks partners Mammoth to help you with things like compliance requirements, drafting job descriptions and requirements, guidance with best practices for hiring new employees and to help you with everything in between.

You can even access a full suite of employee services such as health benefits that’s powered by SimplyInsured and Workers’ Comp that’s powered by AP Intego right inside your payroll account.

15. Funding & Capital

Because of how detailed and thorough QuickBooks is, having up to date records on QuickBooks can help you with securing capital for your business when you’re in your expansion phase and need funds to grow.

You can apply right inside your QuickBooks account with no extra costs or hidden fees without having to hurt your credit score with a credit check. Based on your business history and how detailed and up to date your QuickBooks records are, you can get access to flexible funding at highly competitive rates without any hidden fees or surprise charges.

Click Here To Get 30% OFF QuickBooks

Quickbooks Discount Code: Auto Applied

QuickBooks Drawbacks

There’s no such thing as a perfect or flawless software and QuickBooks like all others comes with its share of drawbacks. Let’s look at a few of them so you can see how major or minor they might be for your business.

One of the main areas where QuickBooks falls behind is inventory management. It isn’t a full-fledged inventory management software, and doesn’t do a good job of replacing one either. This is why, there’s a good chance that if you need to manage inventory for your business, especially for one with a lot of SKUs, you may have to use a third party apps and integrate them with QuickBooks to meet your requirements.

As is the case with highly feature rich software, there’s always a rather steep learning curve for beginners to get a good grasp over the features they offer and to make full use of their functionality. While they try to make it as beginner friendly as possible, with how complicated managing accounting can be, a software with so many features can be intimidating to those that are just learning the ropes of bookkeeping and accounting.

QuickBooks Pricing

QuickBooks Online comes with 3 plans that are tailored to progressively suit a variety of businesses based on their requirements. They offer a Free 30-Day Trial to let you get a hang of their software before you decide to use it for your business, however, at this time, QuickBooks is offering a flat 70% off for new users that are wanting to sign up with them on all their plans if they forego the Free trial option.

1. QuickBooks Online Simple Start

For entrepreneurs starting out and small businesses with basic accounting needs, QuickBooks Online offers their entry level plan called Simple Start at $25/month offering a basic list of services to cover core accounting requirements. These are –

- Tracking income & expenditure

- Accepting Invoices & Payments

- Maximizing Tax Deductions

- Running General Reports

- Capturing & Organising receipts

- Tracking sales & sales tax

- Sending estimates

- Managing 1099 contractors

- Single user access

Now although this doesn’t include inventory tracking, QuickBooks Online includes integrations with many third party apps that’ll help you manage your inventory and save money while doing it.

2. QuickBooks Online Plus

For a small to mid-size business that’s growing, QuickBooks Online offers their mid-tier plan Essentials at $70/month which includes all the features in its Simple Start plan and adds –

- Running Comprehensive Reports

- Up to 5 user access

- Bill management

- Time tracking

- Inventory tracking

- Project Profitability tracking

The QuickBooks Online Essentials Plan is the best in my opinion as it gives you the ability to provide individual access to multiple users and even track inventory, manage bills and project profitability – all of which should cover the requirements of an established business.

3. QuickBooks Online Advanced

QuickBooks Online’s biggest plan – Advanced comes at a whopping $150/month and is best suited for mid to large businesses with intensive accounting requirements. They offer all features of the Online Plus plan and add –

- Running Powerful Reports

- Access for up to 25 users

- Business insights & analytics

- Batch import & send

- Automated workflows

- Customised access by roles

- Dedicated account manager

- On-demand online training

- Ability to restore company data

The sheer price of this plan puts it far beyond the reach of small businesses, but for mid to large businesses, the cost isn’t as significant considering the amount of cash flow they manage requiring such an extensive list of features.

Click Here To Get 30% OFF QuickBooks

Quickbooks Discount Code: Auto Applied

Is Quickbooks Worth it?

So, after looking at everything QuickBooks offers, here’s my unbiased opinion – is it worth it?

Well, that depends on what stage you are in your business journey. If you’re a freelancer who’s just starting out, you might be better suited with opting for one of their smaller plans like the Self-employed plan, however, if you have employees, need to manage payments and want to stay on top of your tax obligations, I’d highly recommend QuickBooks Online as an accounting software for your business.

You can try QuickBooks Online for Free for up to 30 Days – No Credit Card Needed and then decide if it meets your accounting requirements. Rest assured, if you put in some time into working with QuickBooks Online and exploring the entire list of features it offers, you’ll be left wondering how you got by with spreadsheets for so long!

Click Here To Get 30% OFF QuickBooks

Quickbooks Discount Code: Auto Applied

Leave a Reply