It was over 5 years ago when I first got acquainted with the idea of investing and money.

I was a young 15-year-old kid and I was lucky to get my hands on the book “Rich Dad Poor Dad” and just as most of the smucks who read that book I started thinking that this “stock thingy” is so easy.

Being young and naive a book like that can make you believe that all you have to do is just put your money in the stock market or real estate and suddenly you’re rich overnight.

Over the next couple of years, I dived further into the whole idea of money and investing. Read the popular books like “The Intelligent Investor” and even went down the rabbit hole of central banking structure and the Federal Reserve (and all the conspiracy theories that come along with it)

Reading a lot of Finance blog and books published in the 2000s Index funds became all the rave and everyone else who isn’t buying index funds is just stupid. Why pay 2% fees when you can get the low-cost index funds right?

So there I was, a young 18-year-old who probably knew more than most 30 years old on personal finance and investments. Logically the step I took was to create an investment plan and that typical stock/bond ratio with index funds and set a 15 year FIRE plan by investing over 40% of my income.

And I stuck to it.

But I realized that was a stupid mistake.

For starters, setting a 15-year plan means I know EXACTLY what I would want 15 years from now. Which is a crazy idea to actually believe, however that’s a lie we all tell ourselves.

Also, by making a too strict plan I lose the optionality that may make better opportunities come my way.

When I was 18 my maximum earning potential was around $500/month (and that was if I was lucky)

Now, I’m 22 and I can easily charge over $5000/month working as a consultant or even build a business making that much in a couple of months.

That’s a 10x ROI. So for the past 4 years, my greatest investment wasn’t sticking to my “plan” but instead making the best use of my opportunities and pivoting. It was in investing in myself.

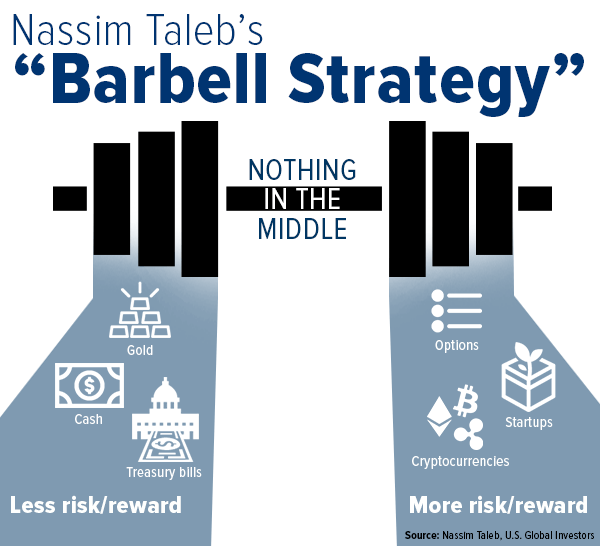

Index funds and most other recommended investment products are usually in the medium-risk category. However, as Nassim Nicholas Taleb clearly pointed out in the Black Swan and Antifragile, people and most organizations are terrible are calculating risk and it’s most likely that the medium-risk investments can blow up. (Especially given that we live in the time of the everything bubble.)

The barbell strategy is an investment strategy where you keep most of your cash in super easy investments ( T-bills, cash, etc) and put the rest of your money in super speculative investments (options, startups, etc)

That’s the VC model of investing and can be applied to so many things in life. For example, have a ton of acquaintances that you vaguely know and a few close friends the kind that you could trust with your phone & nothing in between.

However, in today’s world, that’s a hard model for many people. Because in this model, basically, you are wrong more often but when you are right you win bigger.

That’s the same idea that separates most people I know those start businesses and most people that have traditional jobs. The startup people are willing to start more businesses until one succeeds, while the traditional job person usually wants to know that the idea is 100% sure to succeed before starting a business.

If you invest $100k in 10 ideas and 9 went to 0 and 1 made $1000k. You are wrong 90% of the time but you 10xed your money.

In today’s world being right is overvalued. Achieving your goals is undervalued.

In the best-case scenario of index funds, you are supposed to double your money in 7 years or so.

However, let’s say I had $100k. I would keep $90k in safe cash. And ask myself a question, can I make $10k into $100k in 7 years.

Most people might say no to that question. However, if the answer is yes then the “medium risk” path is usually not for you.

If the answer is no of that question, remember that you can always become a person who can answer yes to that question.

Why do I still recommend index funds

The whole investing in the index etc is an easy strategy and is still honestly the best strategy I would recommend to most people.

I would still recommend them to my parents because I don’t think they would suddenly decide to start a business.

This article isn’t meant to say that investing in the stock market is bad or that you should do it.

I just wanted to share why I don’t anymore. And why I wouldn’t recommend someone like me to do it.

This article is titled “Why I Quit Investing in the Stock Market & Index Funds” and not “Here’s Why You Should Quit Investing in the Stock Market & Index Funds”

My ideas work for me. You need to pick and pull from all the ideas out there and find a strategy that works for you. Don’t just blindly follow the average advice unless you want to be average.

For example, my ideas of investment would fail with a larger monetary amount.

It’s much harder to turn $1m to $10m as it is to turn $100 to $1000, just as it would be much harder to go from making $5k/month to $50k/month than it was to go from $500 to $5k.

Scale matters, they’re no absolutes.

PS. I would recommend you dive further into the ideas shared in this article, read the more traditional stuff as well as more obscure takes on things. Here are a few videos on YouTube I’d recommend if you’re interested.

- Jack Bogle on Index Funds, Vanguard, and Investing Advice

- How The Economic Machine Works by Ray Dalio

- Early Retirement with Mr. Money Mustache

- Nassim Nicholas Taleb | Talks at Google

- Nassim Nicholas Taleb and Naval Ravikant chat

- Taleb Says World Is More Fragile Today Than in 2007

- Financial Collapse: A Panel with Nassim N. Taleb & Robert Shiller – The New Yorker

Cheers

Jeremy

Read Next:

Dropping Out To Travel The World

Leave a Reply