For a long time I’ve shared the following hypothetical situation:

Let’s say you’re a Venezuelan kid and you have a $1 bill. You exchanged 1m Bolívares to get that $1.

You decide to save that $1 bill.

Now your mom gets sick so you decide to go to the shop and spend your last money to buy her medicine. The exchange rate is now 10m Bolívares to $1.

So the question. Should the Venezuelan kid pay capital gains tax on the 9m Bolívares ‘profit’?

Not “will they?”, that’s a question about laws.

My question is “should they”. Did they make any “profit”?

Well your answer to that question comes down to ‘what’s your frame of reference/how are you measuring the world’

So let me take you on an adventure of how you’re trying to measure the world with a ruler that changes in size.

Let’s go super macro and then micro.

Note: Read Price of Tomorrow before reading this article to first have the framework shift while this article is more the technical version of describing our current system. Take the time, it’s worth it. Seriously the book. Not a summary, not a youtube video. Read the book.

Types Of Inflation

Half the time I write I feel like I’m just sharing my definitions of things. But control over definitions = control over conversations = control over minds. Half the disagreements on the internet are just people using different definitions for the same word.

So let me break down the types of inflations/deflation I see in the world. I’m not going to use stupid economist definitions like ‘demand/supply push/pull’ etc. I’ll describe it more simply.

1. Real World Inflation/Deflation

Real-world inflation can be summed up as ‘supply and demand inflation’ caused by the real world.

- Let’s say you are an only child and you now have a brother or sister (population growth). But there’s only one cozy couch in your house. Now demand for that couch has increased making the price of it higher (might have to bribe your sister with sweets).

- The same example, but you had 2 couches, to begin with, and then one broke. So now there’s not enough couch (supply) while demand stays the same, pushing again the price higher.

So that’s it. That’s real-world inflation. Add in technology (making more couches) and you understand how real-world/non-financial inflation works.

Real-world inflation/deflation = an earthquake destroying things/better technology, the population increasing/more factories being built, people’s wants (beliefs like suddenly everyone wants to visit Tulum = prices in Tulum go up, people don’t like fidget spinners anymore = prices going down), etc.

Another way to think about it is “real world inflation/deflation” would be how prices are reflected in a world without central planning or government fiat. (A world that never has and probably never will exist.)

Here’s a good article to understand that hypothetical: Inflation in a Hyperbitcoinized World

2. Monetary Inflation

Oooo. This section just got a lot more interesting…

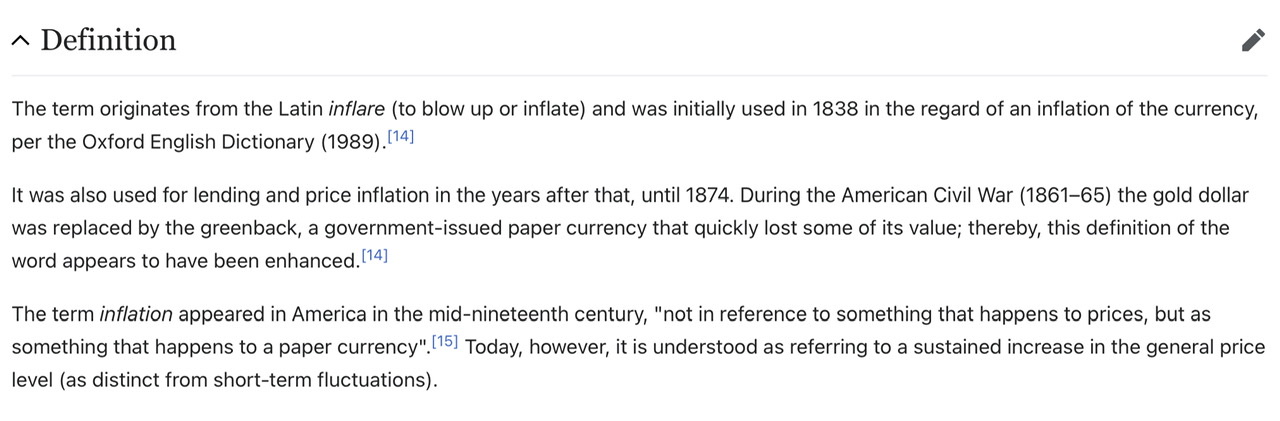

Wikipedia has been changing the definitions of inflation a lot over the past 2 years. Check this out.

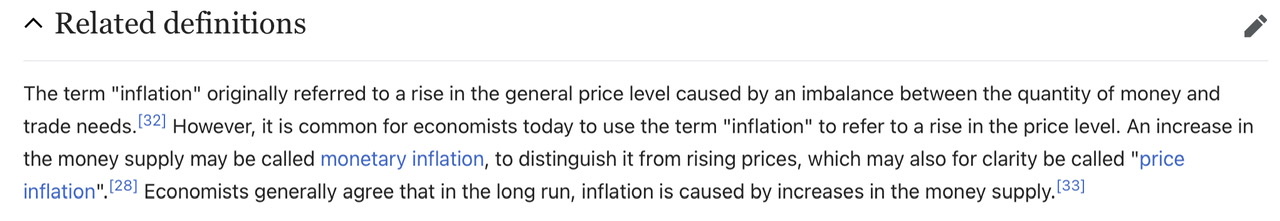

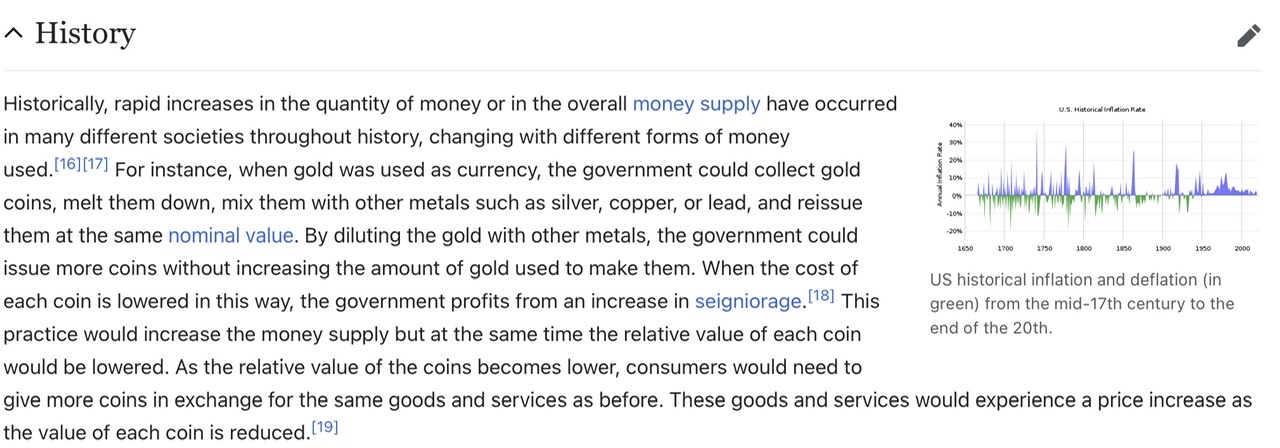

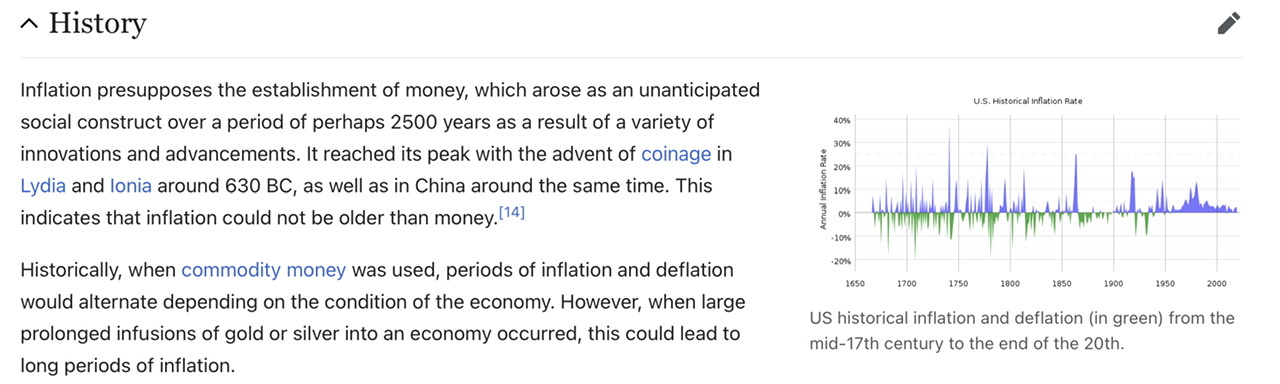

Here are the top 2 sections of Inflation on Wikipedia in 2020: Source

And here’s it in 2024, when all the “inflation is not coming” people were wrong.

Nice, add some Latin, add some bullshit Keynesian words. Amazing beautiful 😻 Lovely 🤌

Honestly, I’m getting to the point when I feel like if you still listen to academic or ‘system’ people and economists wrt money, food, health. You kinda deserve what comes to you, how you be that blind to what’s happening right in front of your eyes? Like seriously.

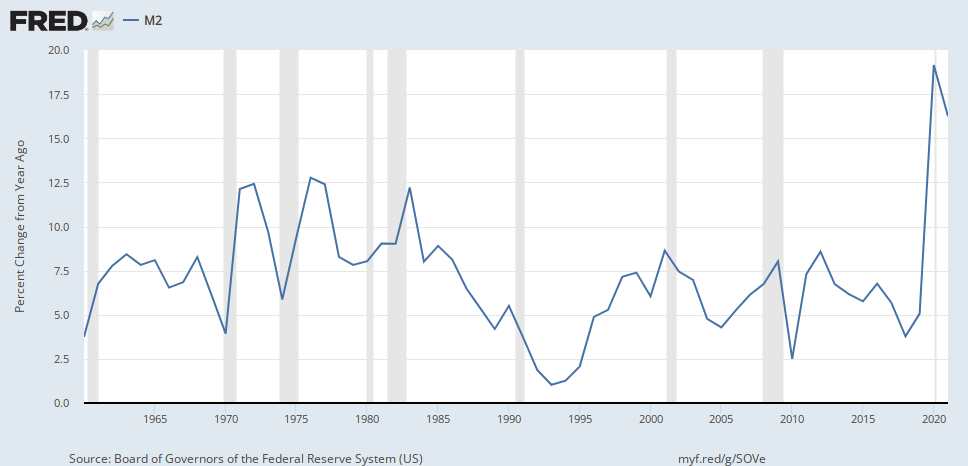

So for all intensive purposes, Monetary inflation/deflation = money expanding/contracting. Any person with half a brain knows that if you expand the money supply that things will get expensive.

Monetary deflation = the “deflation” people say is bad= the financial system going through a debt spiral.

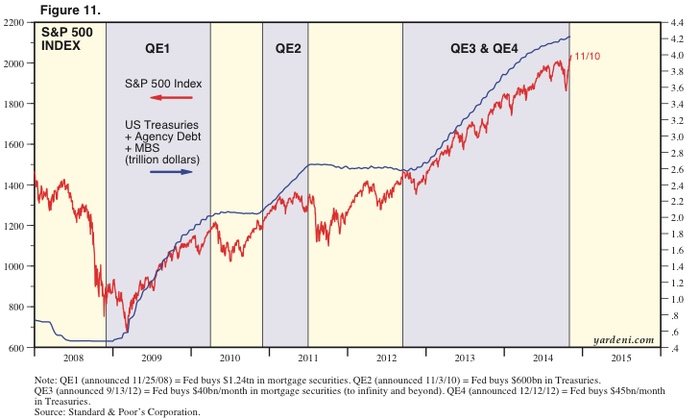

But QE wasn’t inflationary

If you believe this, you’re genuinely stupid or an economist. (Yes I’m going to reuse this joke every time I can)

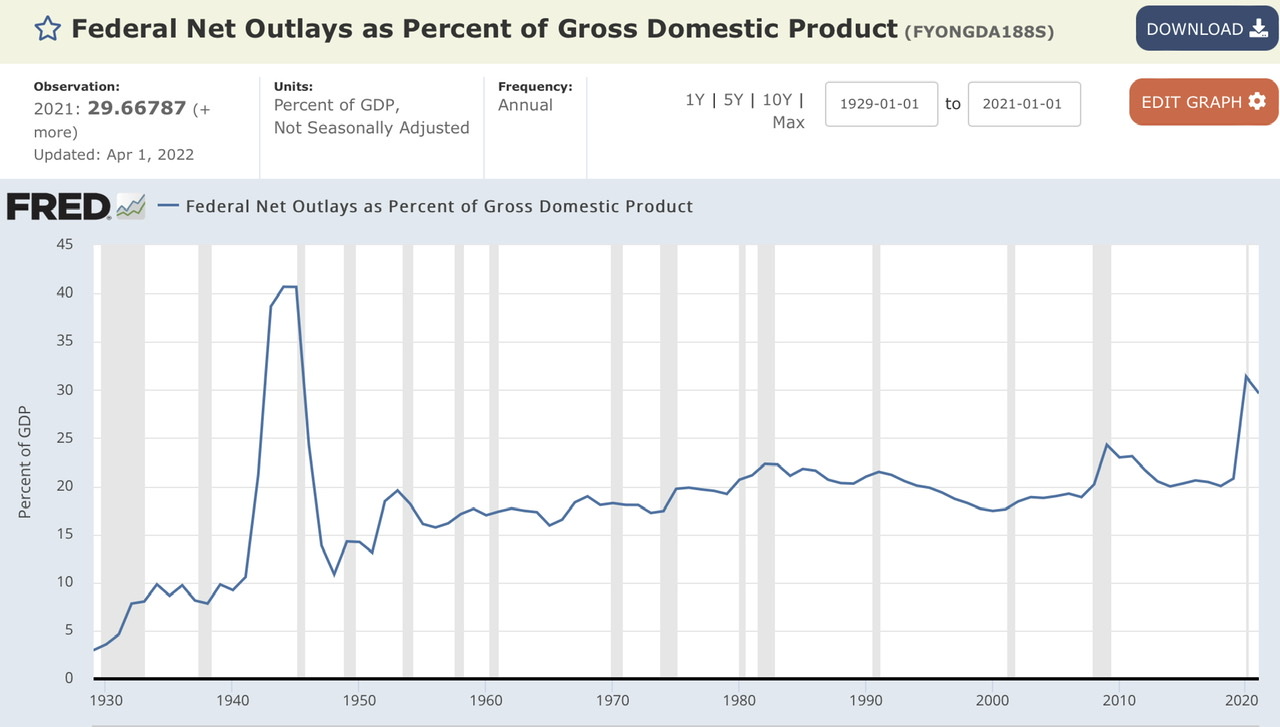

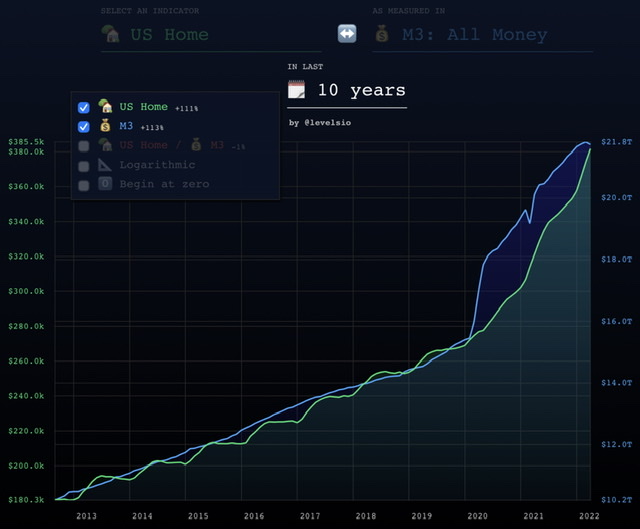

Houses and the stock market went up 1:1 with the amount of money.

”But QE saved the world from the brick of collapse”

Yes, that’s QE 1.

What about QE 2, operation twist, and QE 3? Did you even know that there were multiple QEs up till 2014?

QE’s and stock market (prices of houses are the same trend)

Let me quickly explain the simple version of ‘purpose of QE’ vs result:

Purpose: Simulate the economy to prevent downturns. Banks would create loans to start businesses and businesses would create growth etc.

Result: Fed creates reserves and buys US treasuries and MBS (mortgages). Instead of taking that money and creating business loans, the banks just replace those treasuries and mortgages. So basically only asset markets get stimulated. So houses, bonds, and stocks are up only and thus cause all assets to go up. CPI won’t go up because rich people don’t buy double the meat if they have double the money, duh.

Why does the world need monetary inflation?

Because we live in a world with $200T debt and $20T of money. It’s not like we have a system of money with debt, it’s a system of debt with money.

When economists say that “debt doesn’t matter because we owe it to ourselves or debt is money” it has 2 meaning

- If we create debt, we’ll eventually print money to fulfill that debt. But that’s for the future so doesn’t count now.

But debt and especially deficit creation = not ‘technically’ creating money today but guaranteeing that you’ll create money in the future. - “Ourselves” is a joke because, in reality, it’s more like the young Americans are playing for the old Americans so yes if you zoom out and say “oh Americans owe it to Americans”.

A simple example, people 20 years ago went on Vacation using social security checks but today people who already paid for social security can’t even cover their rent with it. Just because it happens over decades and is government sanctioned, doesn’t mean it’s not a Ponzi scheme.

The best phase would be we’re living in the ‘kick the can down the road’ generation.

Understand Monetary Inflation Deeper

Here’s a simple example I’ve been using to describe this.

Let’s say there are two people in a room, person A and person B. Both have $100 each.

Now for some stupid reason, we believe “2% inflation” is good.

So the total economy in the room is $200, and 2% inflation is $4.

So question who should get those $4 extra dollars?

Imaginary

Person A: I should

Person B: I should.

God: It should be equal.

Person A & B: But then nothing in the room changes? Because we still have the same share of the “room”. We started with 50/50 and ended with 50/50 what’s the point of the extra $4?

Real World

Person A: I lobbied the government/I am the government/I have the guns/I am too big to fail

Person B: “Inflation is necessary for growth, don’t you know that?”

Result: Person A has $104 and Person B has $100.

Person A now went from controlling 50% of the economy of the room to controlling 104/204= 50.9% of the room.

Compound this with a high % over decades and it’s no surprise we have the wealth gaps we do.

Read: Hollow Men, Hollow Markets, Hollow World

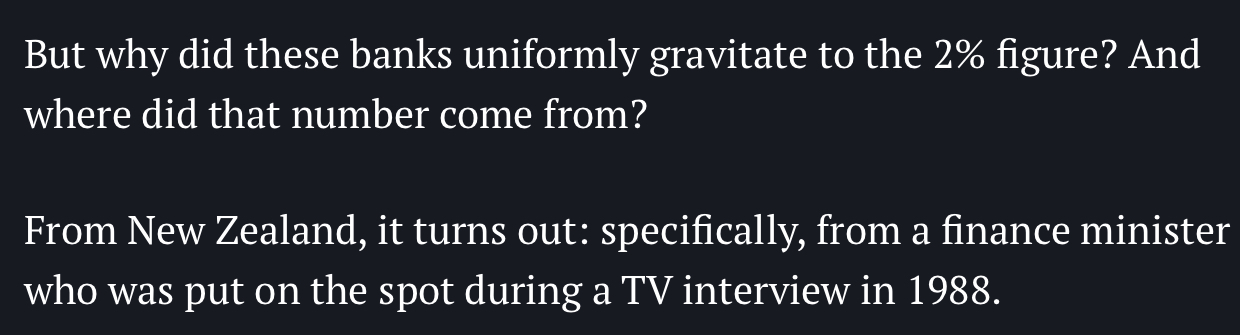

Want to see this clearly in recent times?

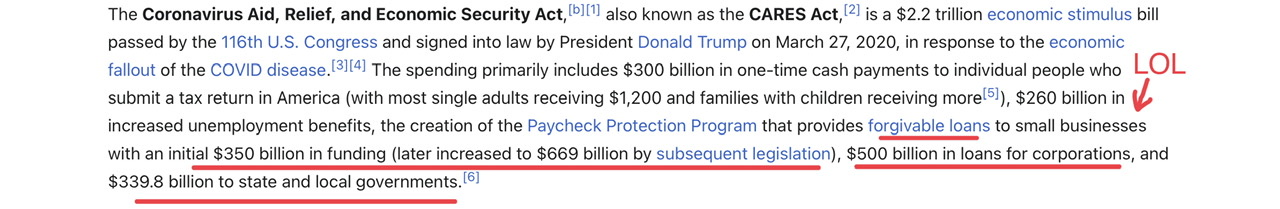

The covid, Cares Act was $2.2T. Each American got a stimulus check of $1200.

But those numbers make no sense? $2.2T/330m= $6875. So….what happened to the $6875-$1200=$5675/person?

(In reality, it’s worse causes the $1200 only went to tax payers)

It’s obvious, ain’t it?

So how does monetary inflation work above for the single bill?

- Fed expands balance sheet by $2.2T

- buys US treasuries

- Treasury Issues $2.2T of bonds

- $1200 of every $6500+ goes to people so they shut up and ‘eat cake’

- fiat privileged people/institutions get the rest and end up getting richer, controlling more of the economy.

But then why do we need monetary inflation

if the money supply was inflated equally then nothing in the economy would change, which would mean there’s no point of monetary inflation.

So monetary inflation is always a redistribution of resources by the government.

But for our system, it’s a necessary redistribution to keep the ‘system’ alive. We live in a world with $200T of debt with $20T of money supply. So the debt is unpayable with all the money in existence.

The hypothetical would be if I create my currency called ‘Jeremycoin’ and give you a loan of 100 coins at 2% for a year and you have to pay me back the entire amount in a year.

A year later, it would be impossible for you to pay me back cause you owe me 102 coins but there are only 100 coins in the world.

So obviously if the debt already exists (which it does) the money needs to expand to fulfill it, right? Or at least expand enough to not cause the system to collapse on itself.

That right there is our entire global financial system. That’s the water we all swim in.

It’s a game of musical chair with debt and currency.

”so then don’t go into debt” well if you pick that option, your competition will go into debt and defeat you.

So a institution, corporation can’t choose not to ‘play the game’. They have to go into debt but also quickly get a chair when the music stops.

So monetary expansion exists to bail out the debt. Most debt that’s issued in the modern day is to just “rollover” previous debt.

It’s borrowing $102 to pay back the original $100, not something productive like factories or ‘roads’ or R&D.

That’s the majority of our economy, our companies, and our governments. That’s our world, again it’s not a world of money with debt, it’s a world of debt with money.

Reasons we ended up here:

- well tbh, it’s not one person’s fault, it’s not even the fault of removable the gold standard, it’s just a lot of little things that compounded over centuries. Here’s one macro framework that takes you all the way from WW1 to today.

- For example: when social security was passed the median mortality was below 60, so social security wasn’t meant to be something a lot of people used. But for nearly a century no politician has the will or could really without ruining their career change it. So yeah, a fake promise made a long time ago= Is the system we have today.

- It’s a lot of little things like the above that compounded over decades to create the world we have today. Yes the petrodollar, but also the capital controls, yes the central planning but also the incentives of the players in the system. Playing the blame game is usually a waste of time.

Tech deflation is Bad for the System

Here’s a question, why shouldn’t apartments or cars be priced like phones?

The iPhone was a luxury good 15 years ago, today everyone no matter where you go in the world has a smartphone (if not 1/user then at least 1/family or community).

Well, for the basic reason that the system would collapse in the world of falling prices.

Houses everyone gets, but why cars?

Question: What are the 3 most in debt companies in the world?

Answers I get: AT&T? Some Chinese bank? Deutsche Bank?

Truth as of 2019 (sadly Wikipedia didn’t update after that)

From the above

- Everyone who says Germany is not in debt doesn’t realize that VW is/was the most in-debt company in the world.

- “But they can service the debt”= let us dance until the music stops/‘not that bad’

- If you are going to justify ‘car financing = productive for society’ go right on ahead.

- VW = german government = debts can’t fail cause they’ll just be pushed up the structure.

- US example: LTCM collapse -> push debt to banks -> 08’ banks collapses -> push debt to sovereign (federal government) -> sovereign can’t default in usd, but will defaults in inflation terms. -> expand balance sheet and keep interest rates below inflation.

- Car companies are also banks. So just as houses can’t go down cause it’ll bring down the world’s banking with them. Car’s can’t go down, the incentive of the system is to keep prices up.

So instead of letting prices go down in nominal, the system will make low cost financing the norm, just like we did for houses.

Why do we need growth?

We only need “growth’ the way economists talk about it in a world where debt exists on a large scale. Cause debt has interest payments and interest compounds.

Again debt is not necessarily bad, but the level & use of debt matters. Having an economy of money with debt inside it is fine but ours is a debt world with some money.

I recommend reading Debt by David Graeber, it’s long and very repetitive but at least worth skimming at least through most of the book.

Frame of Reference

In my article Freedom, I described degrees of freedom that shows how freedom is a spectrum.

I’d like to do the same with measures of inflation.

1. Indian using INR

It’s easy for me to use INR for this example but this logic applies to almost every country.

So Indians look at the world from an INR lens, they believe their ‘expenses’ are in INR. They negotiate in INR and try to just get more INR.

Cool.

But in reality, if you zoom out most of their costs aren’t based on INR. Oil prices affect global food prices and oil isn’t denominated in INR it’s denominated (and changes) in USD.

Here’s a better example,

An Indian can earn 6% on their Inr by depositing it in the bank for a year. “Wow, 6% that’s a lot!”

It’s in INR.

Take the whole past 20 years.

For almost every year if you started the year with $1, converted it to INR, earned interest on it, and then converted it back to USD, you had less than $1.

Even worse if you count treasuries.

Look carefully at the above charts, one is the 10yr India yield in INR, and the other is what happens when you convert it to USD, 3rd is treasures (aka risk free USD rate)

Now you might say that it’s still positive and you’d be right, but that’s before taxes.

So best case scenario for an Indian is

- 1 USD into INR

- Earn Interest on INR

- Pay tax on those INR ‘profit’

- If lucky be able to buy 1 USD again.

So everyone in India that uses INR as a ruler would just find the world (in USD) getting more and more expensive.

So simple, INR doesn’t matter and USD is a better ruler. How does the Indian Stock Market now look when you consider it in USD Terms?

Instead of 80% in INR, your reality is only 44% over 5 years for the index.

So to spell it out in simple terms. If you invested in S&P 500 you would have 73% more dollars, if you invested in India you would have 44% more dollars.

But Indians think India is growing more cause they got 88% in INR.

So as a lens to look at the world we can all pretty much agree that USD>INR.

Even if you’re going to live in India your entire life using INR as a measuring stick is stupid as almost all the things you’d spend on are better priced in USD.

Conclusion: If you use INR as a measuring stick, you ‘might’ be able to stay in one place in India (afford necessities) but as time goes on you’ll complain about everything about India getting expensive (vacations, flights, etc)

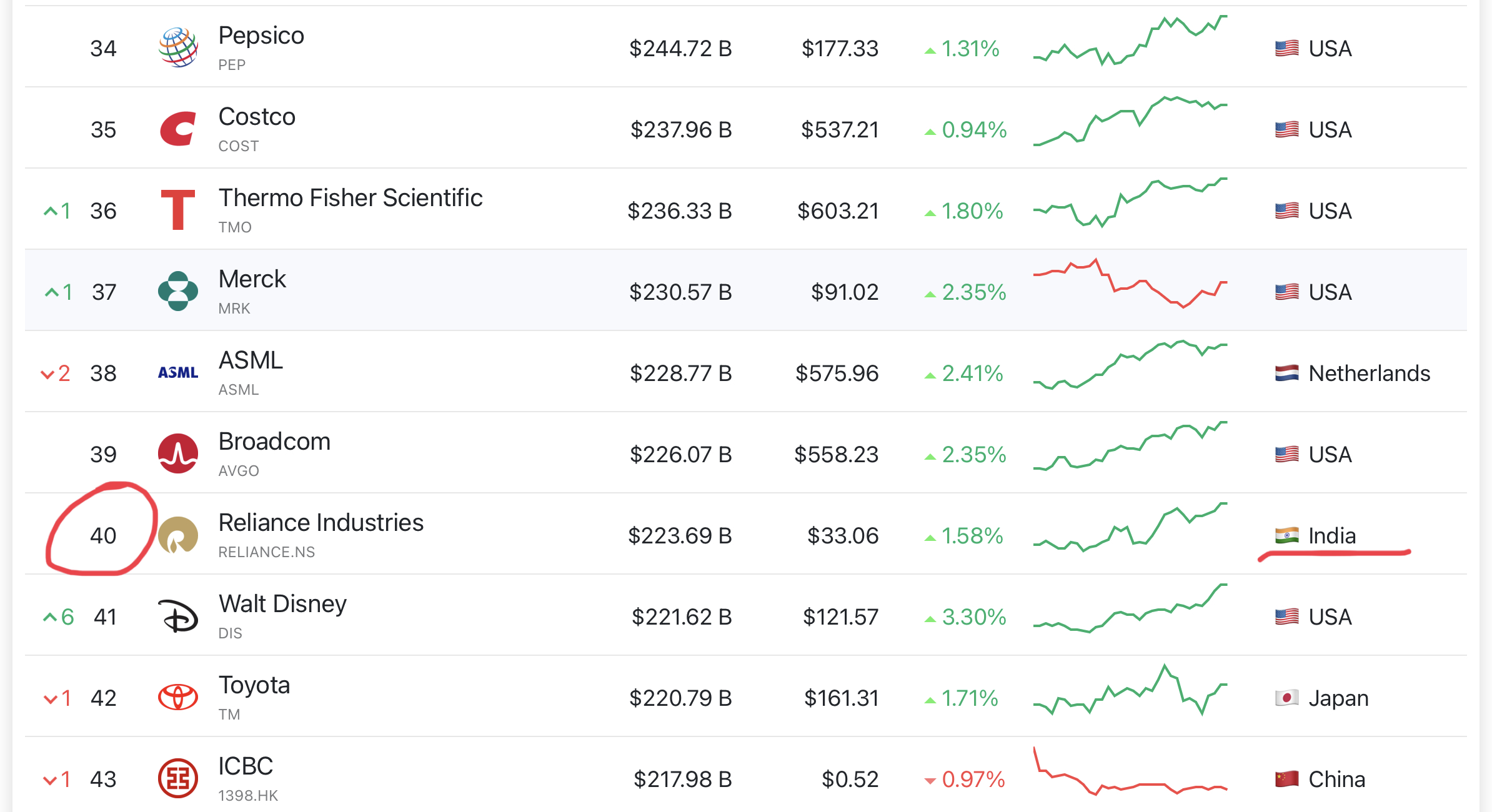

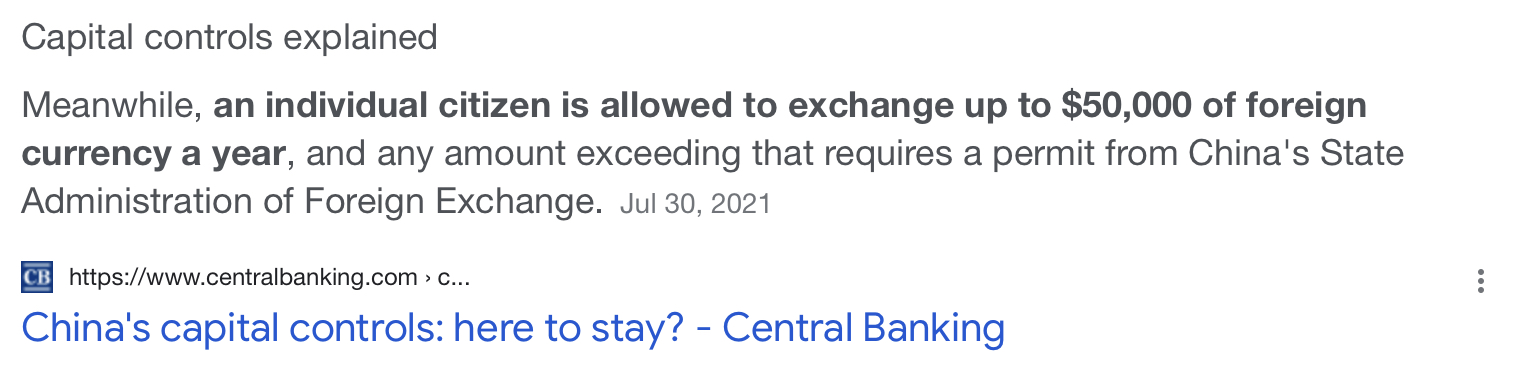

Why can’t Indians hold USD?

Why do countries like India put capital controls on the currency and restrict how money flows?

A simple way to understand this would be if India (the country) has $1m in Dollars and 100m in INR. In the above scenario, every India could theoretically take 100 INR and go get 1 USD.

But the Indian government has guns, so why should they let you take those juicy $s? A better reality is where Indians are forced to hold their INR, the government can print INR from thin air, and they don’t put restrictions on their limits so the country as a whole can use more $.

But by limiting indian individual from spending those inr easily, the ‘govenment/country/larger system’ is able to get a better exchange rate of 70 per 1 USD. More on this later.

Capital flight is used as a bad thing ‘those evil people’. But as I shared in Pespective, it always depends on who’s pov you want to pick.

So you sacrifice the individuals’ or companies’ ability to hold $s to increase the country’s ability to hold $s.

Read: Why Asian Families sacrifice the individual & the Gold Standard “failed”

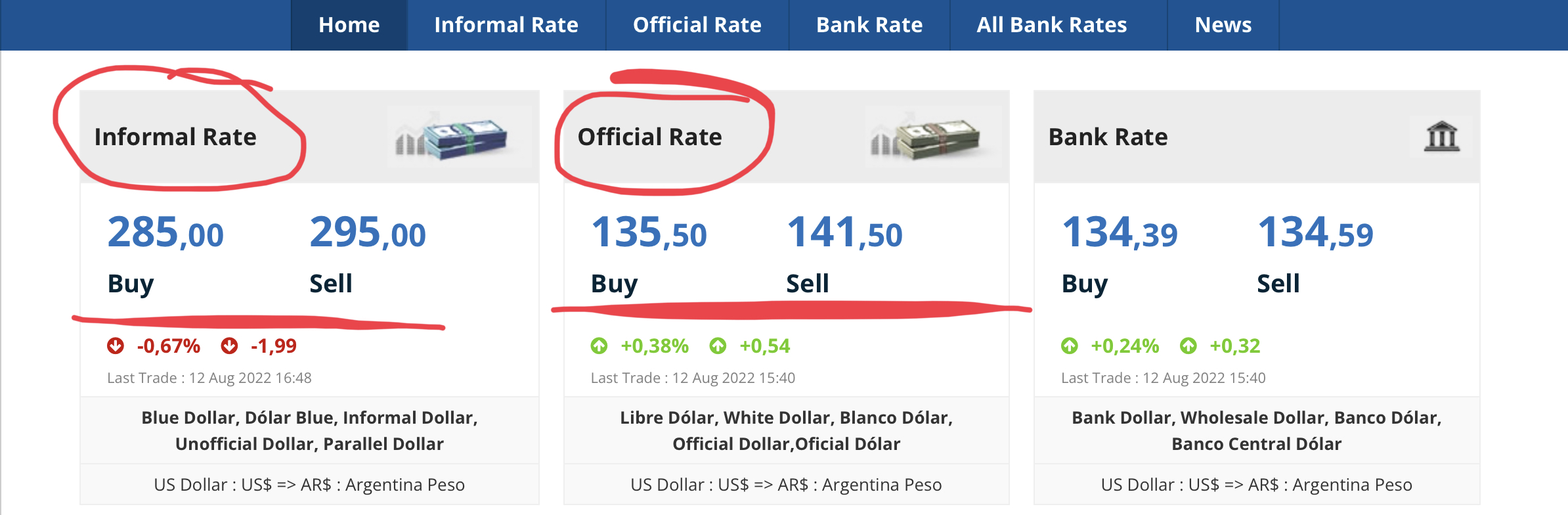

The idea of stealing the population’s ability to hold $s to help the sovereign is best seen in Argentina. Today if you send $100k from a bank account in New York to a bank account in Argentina you will get 13.5 M Peso.

If you then take those 13.5 M peso, withdraw them, and convert them to $ notes. You will get $45,608 in cash. It’s even worse cause you’ll have to pay tax on those 13.5 M at 31%

So if you work hard and earn $100k and you send it through the banking system then the Argentinian government is going to take away $54,392 by giving you a fake exchange rate, and then they’ll take another 30% ($13678) in Taxes. So you only get $31,925, nice :)

What’s one possible definition of a slave? Someone who has a tax rate of 100% and who keeps 0% of their labor.

This might be a good time to go read the Illegal vs Legal section of my previous article.

2. USD + CPI

So if USD is better than INR or any other fiat currency, isn’t CPI-adjusted USD even better?

Yeah basically. This is what the majority of Americans use to look at the world and “real wages/pensions” etc are calculated based on CPI.

I wouldn’t recommend anyone use it for the following reasons:

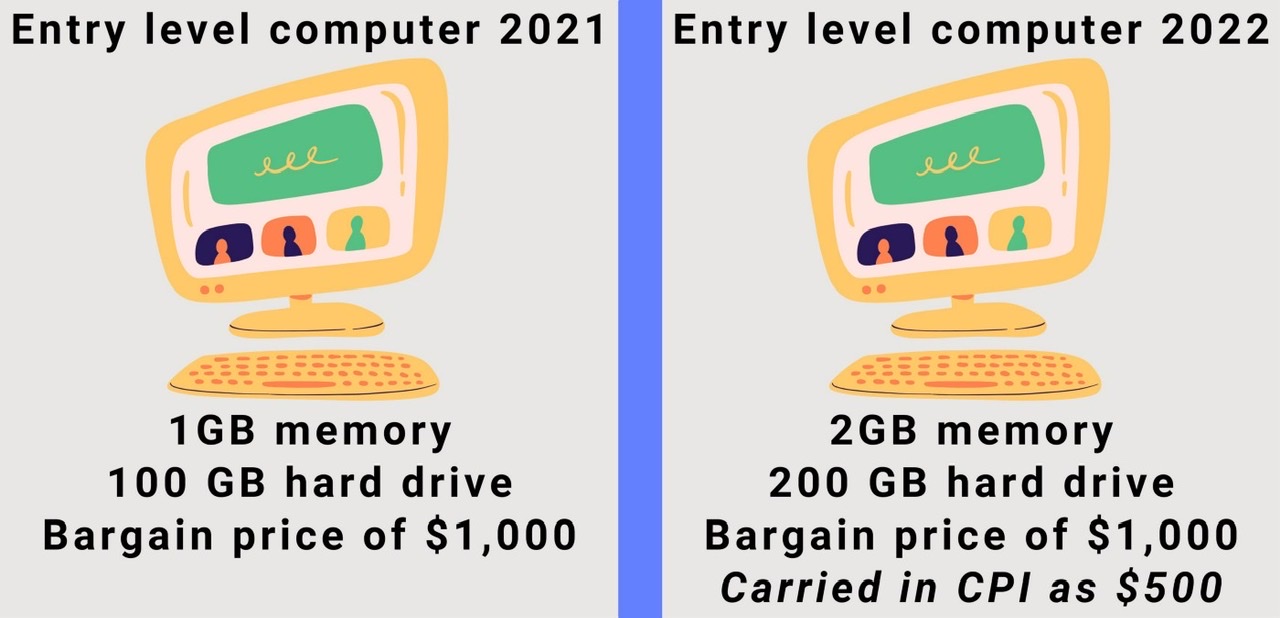

- Hedonic adjusted and replacements (eg beef is substituted for chicken) means CPI does not calculate ‘cost of living’ for anyone.

- Calculates normie world aka the cost of wheat, sugar, basically shit unhealthy-die-early-due-to-diabetes-supermarket-food

- Doesn’t count things that matter like houses, vacations, quality of life, etc.

- It’s almost a ‘end up as a serf’ metric.

- Only relevant from a ‘cpi rate -> fed hikes -> bond yields -> markets’ irrelevant for life.

Why does CPI need to be false?

Interest rates have to be lower than inflation to sacrifice the bondholders for people who took the debt (I talked about this in the financial repression section of my house article).

Similarly, CPI is very important for the normie world: the amount of $s pensions payout is based on cpi, government salaries are usually tied to CPI etc etc.

So basically lower/manipulated cpi means that pensions and social security can “soft default” on their promises. So yeah you’ll still get your pension but instead of paying for a happy life, it barely covers your food.

2.x Better versions of CPI

You can use shadow stats or stuff like Truflation. I would consider this ruler the “survive” aka what you need to survive without compromising.

I’m not against recommending using shadow stats as a ruler if you’ve already acquired assets and want a metric to calculate a simple life (older, retired, monk etc) but don’t think it’s a good ruler for young people.

3. USD + M2 Adjusted

Every time people understand the above idea there’s always a reply:

”Wouldn’t it be nice to be able to create an index of your spending where you can add all the things you spend money on and measure that? You own personal inflation index, we could build a SaaS for that!”

My reply is always, why waste your time where there’s a simple approximate measure? It’s not about knowing the exact % to the tee it’s about having a range.

Here’s the inflation metric that is 1:1 for every young person ‘not-too-hedonistic’ needs.

Here’s my case for why USD + M2 is the rate you need to use. (You as a person, don’t waste time on others)

1. House prices as a whole go up in lockstep with m2/m3.

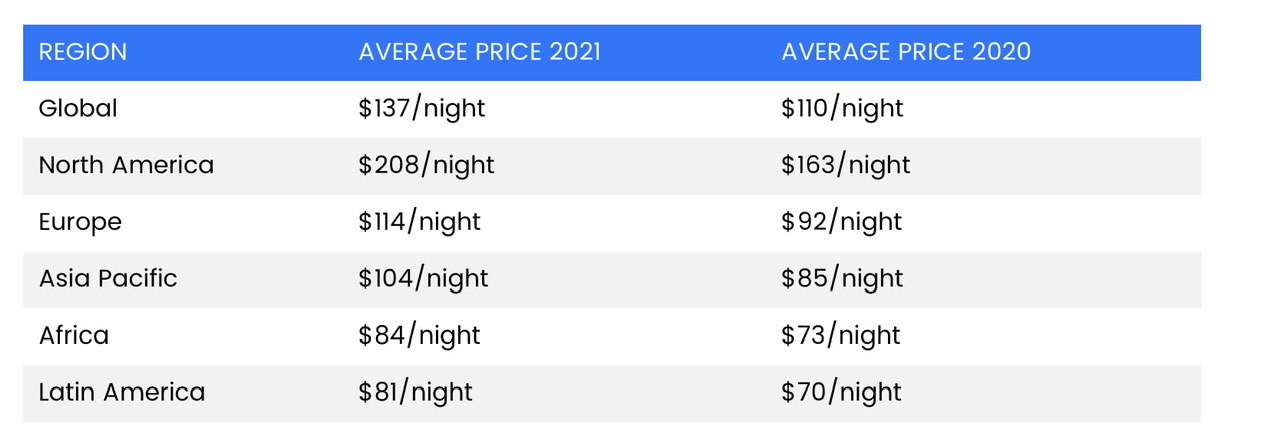

2. Flights, vacations, Airbnbs everything you want goes up around the same percent as M2.

Anything less than USD+m2 means you’re talking about just ‘surviving’ and not thriving.

M2 tends to be a good ruler for the price increases of “the things society values”.

do you want to accept that inflation (in USD) was 20% in 2020? Data: Airbnb prices

Here’s an example, if you adjust stock markets to M2 you find that most markets haven’t gone up in the past 15 years and have just been flat and retained your value.

So in my inflation-adjusted terms, you didn’t make money in the stock market, you just retained your spending ability.

People everywhere think they’re getting rich but it’s just the currency that’s losing value.

For example check out India’s stock market when adjusted for USD and M2

Metric higher than m2?

The reason I picked m2 is because I wanted something simple that I don’t have to spend a lot of time on and I have a ruler to measure the world. It’s the minimum ruler you need to use if you want to thrive. There’s nothing wrong if you want to use something higher.

If you want to consider the cost of private jets and islands you probably will need to have a higher metric than M2.

Life is a choose your own adventure game, soo pick the metric that works for you. But here’s how I see it.

- Pick INR: you survive in India but life outside becomes further and further.

- Pick USD: You’re thriving when you go to non-USD countries (eg. Vietnam, Philippines) but struggle to survive in Europe and the Western world.

- Pick CPI/Truflation USD: You survive in the Western world but as time goes on, the percent losses compound, and assets like houses get impossible to acquire.

- Pick USD M2: You can always afford to do whatever you want, anywhere in the world as long as your desires don’t increase too much, too quickly.

Excuses for Bad Measures

So what happens if you use an inflation rate less than USD+M2? You or the person who uses a bad metric of inflation will probably say one of these things:

- ”We don’t vacation in the Mediterranean anymore because they raised the price too much”

- That shopkeeper tried to cheat me and sell that thing for $2 bucks when ‘I know’ it costs $1

- Flights shouldn’t cost more than $500

- That Airbnb host in Mexico City tried to overcharge me, I won’t be taken advantage off!

- There’s no inflation, the corporations are just greedy. (this always gets me laughing)

In a water-in-wine society, the man who wants pure wine is considered ‘spoiled’.

Why Do People Use Bad Rulers?

I’ve thought a lot about this and the main reason would just be the water that people are surrounded by, people use the rulers they do for the same reason they pray to the god they do; cause that was what everyone around you did.

Other than that here are a few reasons.

1. Justifying Immorality

If you use USD + m2 you’ll feel like the Venezuelan with the $1 felt, that the taxes you’re paying are immoral because you aren’t even making a profit.

If you are Indian, you aren’t allowed to hold USD easily. And If you go through the process of holding USD, you’ll have to pay tax on USD going up against INR. But you didn’t make any profit so it’s basically your government stealing your money, which is true.

Your house didn’t go up in price: it’s not like you had a house, suddenly George Clooney moved in next door, your house doubled and you can now sell it and buy two houses.

If you sell your house you’ll have more USD but still only ‘money for 1 house’, just like a Venezuelan has more bolivar but only 1 USD.

Instead of coming to the realization that you’re taxed on stuff that’s not “profit” or “gain” while still realizing that there’s nothing you can do about it, it’s easier to justify the immorality of Government stealing.

2. You’d have to level up

If you use M2 as a ruler, in 2020 you would have to increase your income by 20% IN USD terms to just stay in one place.

No normal world salaries grew that much, which would mean you’d have to leave the normal work world. Never have an employment contract ever again or if you do, you switch for better jobs quickly.

I remember when I started working back in 2016, I used to have the belief that my income should increase a minimum of 50% a year. When m2 was less than 10%.

And I believed I would learn enough in that one year to justify the increase.

”Jeremy I don’t agree with your framework and I don’t believe in using USD + m2 as inflation”

Cool, it’s your life and you’re free to use whatever metric of inflation you want, I just believe that everyone that uses an inflation rate less than ‘USD + m2’ will have to pick one of these 2 options:

- It is what it is/karma/This is how life is/we are Indians we earn in INR and that’s how it’ll always be, basically accept your situation.

- Find someone to blame/tax the rich/greedy corporations/fight for central control of industry/burn it to the ground/a boring dystopia, anger towards the system.

Capital Controls and Fake Prices

When I started learning about finance I used to have the belief that it was an economy of productivity with some stagnation and zombies in it.

Today I’d say it’s an economy of decay and death with some bits of productivity in it. (Jobs that create value for society are the exception, not the rule especially in the financialized corporate world.)

I’ll like to share a few details to show you examples of how manipulated markets bias the way people look at the world.

It sounds hyperbolic but without a ruler how can you measure anything? How can you value anything appropriately?

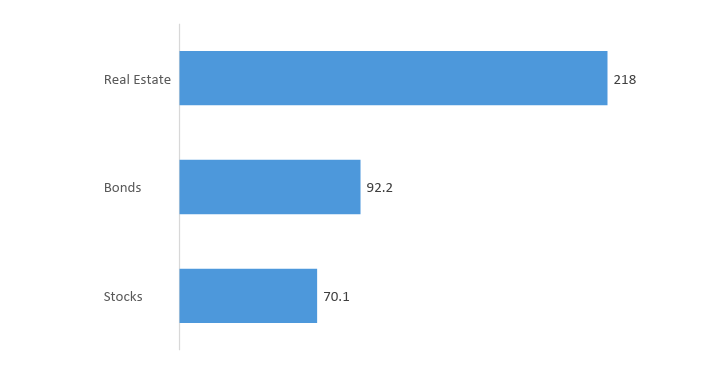

1. Most Valuable Asset Class in the World

What’s the most valuable asset class in the world? Stock? Bonds?

Nah, it’s real estate.

$218T

”Those fucking Americans always going into debt, they’re going to create another 2008”

umm, no.

American real estate isn’t the most valuable in the world.

🫤 wait…what?

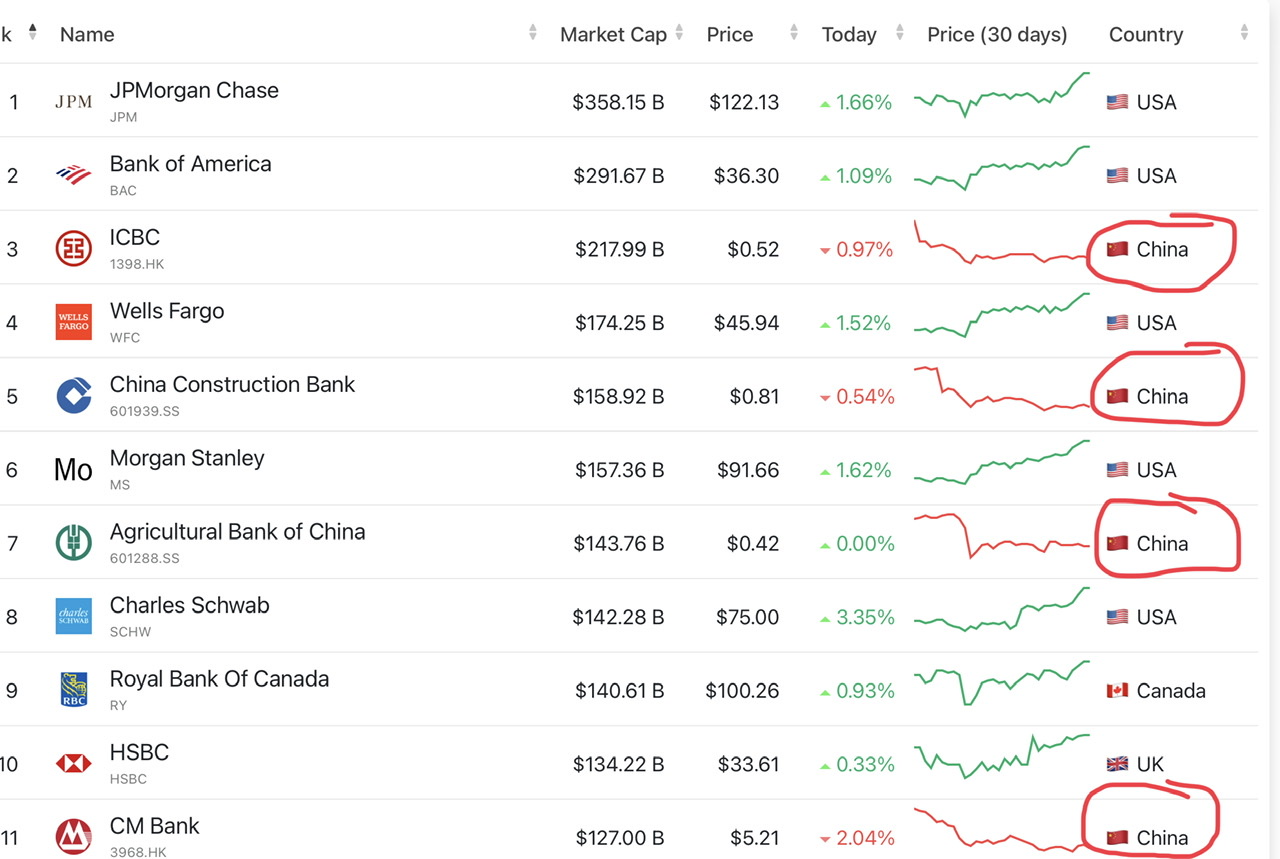

2. Mumbai real estate costs more than NYC

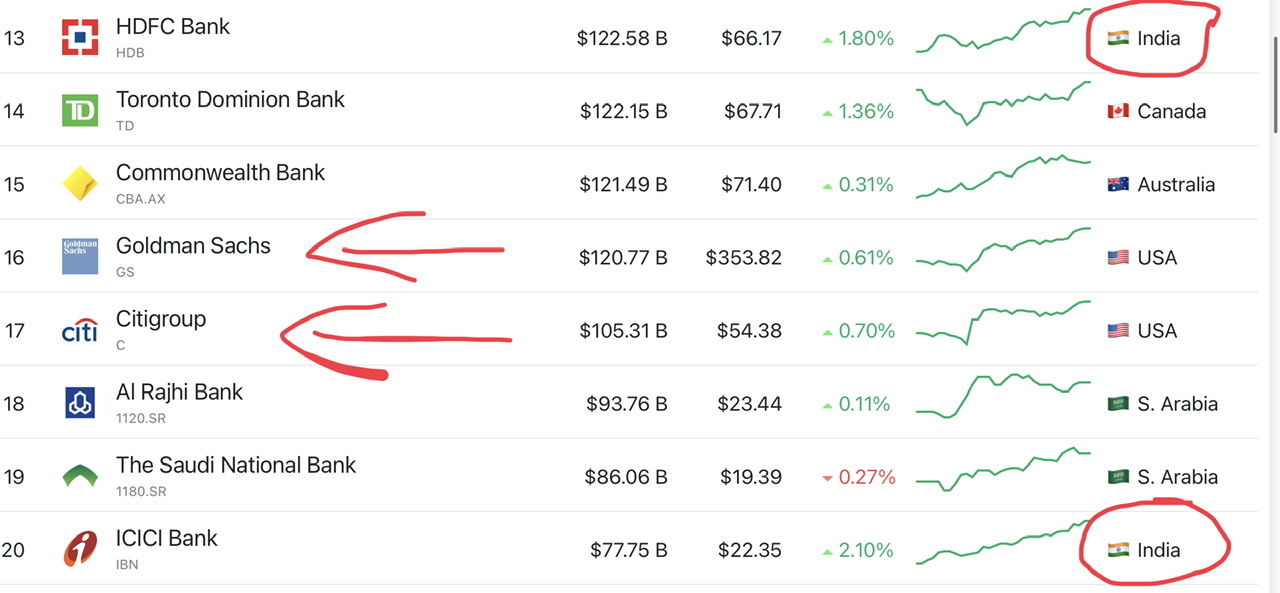

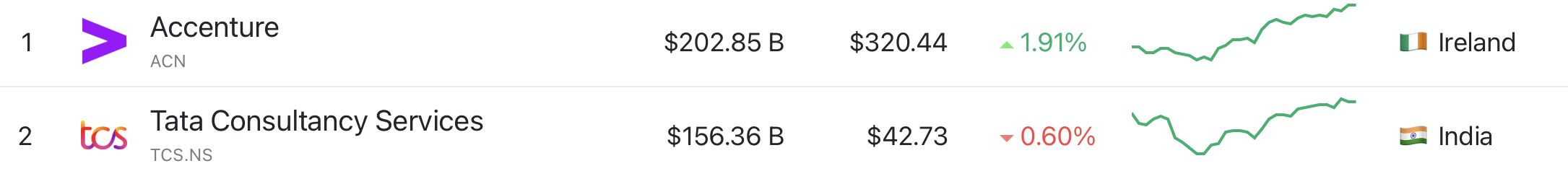

3. Valuation of Indian and Chinese banks and companies

Alright, there’s probably one of 2 thoughts you have right now.

1. Wow the world is much more different than I thought. Maybe I was wrong about Asia. It’s not that the future is going to be there, markets are showing us that it is already the present.

2. These markets and valuations make no fucking sense. Wtf is wrong with the world?

If you go with thought number 1 you probably have the belief that “markets know more than me”. If you have thought #2, read on cause it does make sense.

So a simple question. The person that buys a house for $1m (8crore INR, 6.7m Yuan) in Mumbai or Shanghai, do they have the option to buy the house in Manhattan?

No. They literally don’t have that option.

Some people do go around these rules but that’s the minority. For the most part in both India and China, the money can’t move out of the country.

Effective markets can only exist where you can pick between A and B without any restrictions. But half the world’s population can’t even send their money out of the country, this is everywhere in our world they’re no “free markets” in almost anything.

Check where your country imports beef or pasta from and you’ll find a meeting of ambassadors or a ‘free’ LOL trade deal. Eg. El Salvador can’t buy Argentina beef and has to buy US beef.

Let’s go deeper, obviously, Mumbai real estate isn’t “worth” the same as New York by any person that thinks. It’s just “priced” the same. (Too smart by half people can come up with a quick explanation like ‘they’re a lot of people’ etc)

Idk what it is with academics of finding stupid explanations to ‘justify’ things vs just observing reality and saying the ‘price/market/people’ are wrong.

This means that if everyone in Mumbai was given the option to swap their apartment for an NYC apartment they would. In an instant. But they can’t.

This means the ruler used for measuring the apartment is wrongly calibrated.

This is our world, there’s a big difference between value and price.

Another, Memetic view on it would it: Just because other people value things high doesn’t mean it’s worth their valuations.

the battles are so fierce because the stakes are so small. – Peter Theil quoting Kissinger highlighting Sayre’s law

And yes, you can just stop playing other people’s battles.

https://www.twitter.com/JeremyNoronha/status/1575375108331413504

In simple terms, it means you can’t compare an asset that’s priced in INR vs the same asset in USD because the Google rate of INRvsUSD is just as fake as the Argentinian rate. It is also why INR and Yuan are (and will continue to be) down only currencies vs USD.

> This right here is also the reason I don’t understand people who talk about PPP and use that to compare the world. Like wtf? A vacation in the Maldives will cost the same irrespective of where you’re from and the price of oil is usually the same excluding taxes. PPP is literally another example of “but those people can survive” and is a way of making people think that just because they were born somewhere that they should earn less or whatever.

So Jeremy what’s the Trade?

Recently someone asked me, “is it a good time to buy bitcoin?”

I replied, “it’s always a good time to learn about about bitcoin” (book list)

Same logic here, inflation is a deep rabbit hole, half the ideas I shared in this article are things I learned just a few weeks ago. There’s always something new to learn.

Ignore the shallow ‘M/M vs Y/Y’ or “bitcoin failed as inflation hedge vs new narrative is that its a debasement hedge” and go deeper learn how ‘Euro dollars’ work but then also realize that the dollar milkshake theory is true but not all-encompassing.

But since you’re here and want a trade, here are my ’lightly held heuristics’ for the future. *speculative section of the article starts here*

- M2 % growth will be high for the next decade, probably double digits most years.

- Interest rates will stay low, probably -5% vs Truflation rates.

- CPI will go down in short term but will probably hit double digits the next time we have a fiscal stimulus.

- The world is deglobalizing but technology (The largest factory in North America was built in a year) is quickly filling in the gap caused by that inflation so over years won’t matter but will matter in the short term.

So basic idea/trade would be.

- Denominate your life in USD, other currencies don’t matter at all, if you live with another currency stop paying attention to it entirely.

- Adjust how much you think things should cost based on M2 (if things cost less, which they will often you’re getting a deal), it’ll lead you to negotiate your entire income, work on min-m2 growth and also stop complaining about the reality of prices in the world.

- Cash is useful for a emergency/safety net but cash flow that grows is even better.

- fuck bonds

- Being in debt is good if you can get a government-subsidized mortgage, outside that it is rarely good.

- Hold diversified (for anti-fragility) hard assets (FYI BTC has always traded based on m2 growth)

- Don’t let debt make you fragile, you probably don’t want the mortgage to be more than your 1-year income or 10-20% of your net worth.

- You should be able to sell assets to pay off your debts entirely (don’t get a -ve net worth, it makes you fragile, especially wrt taking a break and reinventing yourself and jumping s curves)

- Not all the world is going to shit, leave the shit places if you can.

Cool, that helps the individual, what about the system?

Haven’t you been paying attention? society is always a tug of war between different categories of groups trying to extract more from each other. Not always a bad thing, taxes can be productively used.

Life is risk, and then you die

*Real* economics is the study of scarcity, politics is the denial of scarcity.

But it’s easier to optimize your individual life, family and friends than it is to change the system and reduce inflation for everyone, the incentives for the system are just not the same especially not in the short term. So while I do think they’re possible scenarios it’s less useful to talk about because it probably won’t matter at all.

If you want to help everyone, don’t work in politics. Instead, create something.

Work in real-world technology that will make life easier, whether it’s in robotics that makes factories more efficient or makes energy abundance a reality or tech to build houses easier, or tools that make it easier for companies that want to work remotely do it seamlessly, AI, work In regenerative farming, teach other people how to understand ideas (like inflation 😆 *silently pat my own back*) etc etc.

Now that you have a ruler you know how to measure the world so you can focus on Make, Protect and Teach with a little bit of ‘just enjoy life’ cause you’re human after all ;)

Leave a Reply